Introduction

The Indonesia mobile market comprises several operators, of which four have their own networks: Indosat, Smartfren, Telkomsel and XL. Regarding mobile telecommunications, MNOs are the main player of interest for TowerCos. The objective of this report is to provide a summary of the current opportunities for TowerCos in the country as a preliminary estimate.

This report provides this summary based on the following KPIs:

- Differences in coverage by MNO: not all MNOs may have the same coverage 4G and 5G along the country. Global and regional differences may help TowerCos to properly approach MNOs.

- Degraded coverage areas: areas of the country where the network (in 4G and possibly 5G) shows degradation.

- Potential co-location opportunities: co-location agreements reduce the building, installation and maintenance costs for MNOs, while improving profitability for TowerCos and optimizing space usage and resources for everyone.

- Potential BTS opportunities in urban areas: urban areas are some of the most interesting zones for performing new deployments for MNOs.

This report is divided in two great blocks:

- Block 1, with an analysis at a global level.

- Block 2, focused on BTS opportunities in urban areas, where deployments are more adjusted and optimized.

Summary

Indonesia, with over 279k inhabitants and being the 16th largest economy in the world by GDP, is a vibrant and dynamic economy in several fields, including the mobile telecommunications market. Being a large archipelagic country, there are major differences between regions, both in the mobile deployment and other subjects, specially between the island of Java and other regions.

Four mayor players dominate the mobile market with their own networks: Telkomsel (by far the largest MNO in the country), Indosat-Three, XL and Smartfren. Several MVNOs, with a more reduced impact, are also present in the country.

The partially state owned Telkomsel dominates the market with over 50% of subscribers market share. It also has the widest deployment, even in rural areas.

Indosat and Three merged in early 2022 under the name Indosat Ooredo Hutchinson, sharing infrastructure and network (and thus will be analyzed together in this report as Indosat-Three) but keeping different brands for prepaid (Three) and postpaid (Indosat) subscriptions.

Smartfren, the most recent competitor, is growing steadily with a focus on the latest technologies and urban areas. According to the Indonesian regulator, in September 2023 XL and Smartfren entered talks about a possible merger with the aim of consolidating both companies.

Co-location opportunities in the whole territory

- Smartfren has no coverage whatsoever in East Nusa Tenggara, Maluku and Papua. Should they have interest in extending their network to these areas, the opportunities would be numerous. However, a possible merger with XL reduces the likelihood of an expansion in these regions.

- Telkomsel has a far larger possibility of providing co-location opportunities because it has the largest coverage area, whereas Smartfren has the largest possibly of receiving co-location opportunities due to its smaller coverage area.

Potential BTS opportunities in urban areas

- There are three regions without Smartfren deployments (East Nusa Tenggara, the Maluku archipelago and Papua) and overall, less coverage than its competitors, which opens room for expansion. XL, however, has a wider deployment including those areas, so in the case of a merger this opportunity may not be as attractive.

- The construction of the new capital city of Nusantara in the isle of Borneo is expected to finish its first phase by end of 2024. This is a clear opportunity for all players in the market.

- Smartfren has more BTS opportunities because it is the MNO with the smallest coverage area.

Methodology

Under this section an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

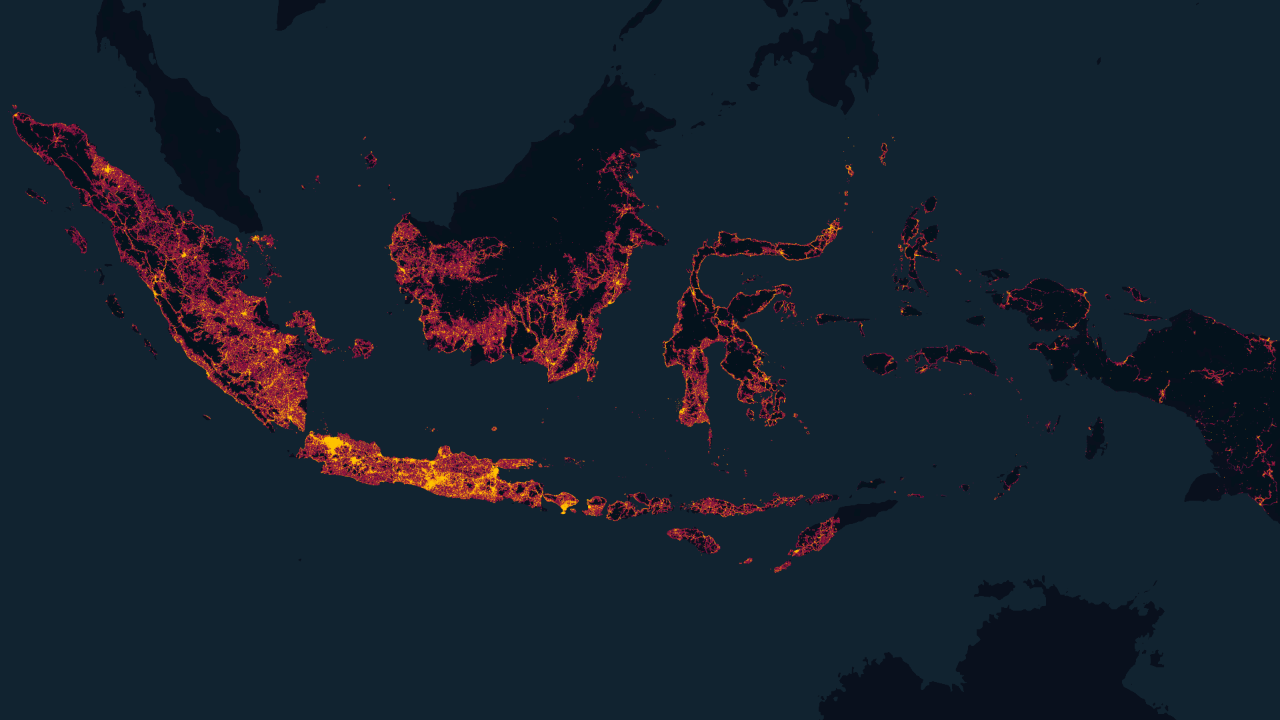

At a more general level, Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 1.690 million measurements collected between july and september 2023 were used.

The following map shows the density of measurements taken throughout Indonesia by Weplan Analytics.

The most relevant insights can be found in the Summary section above. A detailed account of each one comprises the rest of the report below.

As the four aforementioned MNOs serve their networks to other parties (such as VMNOs, due to roaming agreements or as part of emergency coverage) they have been filtered by the network provider reported in the SIM card.

More details about the methodology can be found here.

Division of Indonesia for the analysis

The situation of Indonesia, with more than 17k islands (of which 922 are permanently inhabited), and great differences in development between them, calls for a division of the country in several areas. Given the high-level nature of this briefing a province-level would be excessively detailed. Thus, a mix of geographical partitions (by archipelagos, such as the Maluku, or great islands and its neighboring, smaller islands, as with Sumatra) and political (by provinces, such West Nusa Tenggara and East Nusa Tenggara) has been applied for the analysis.

Block 1A: Differences in coverage by MNO in the whole territory

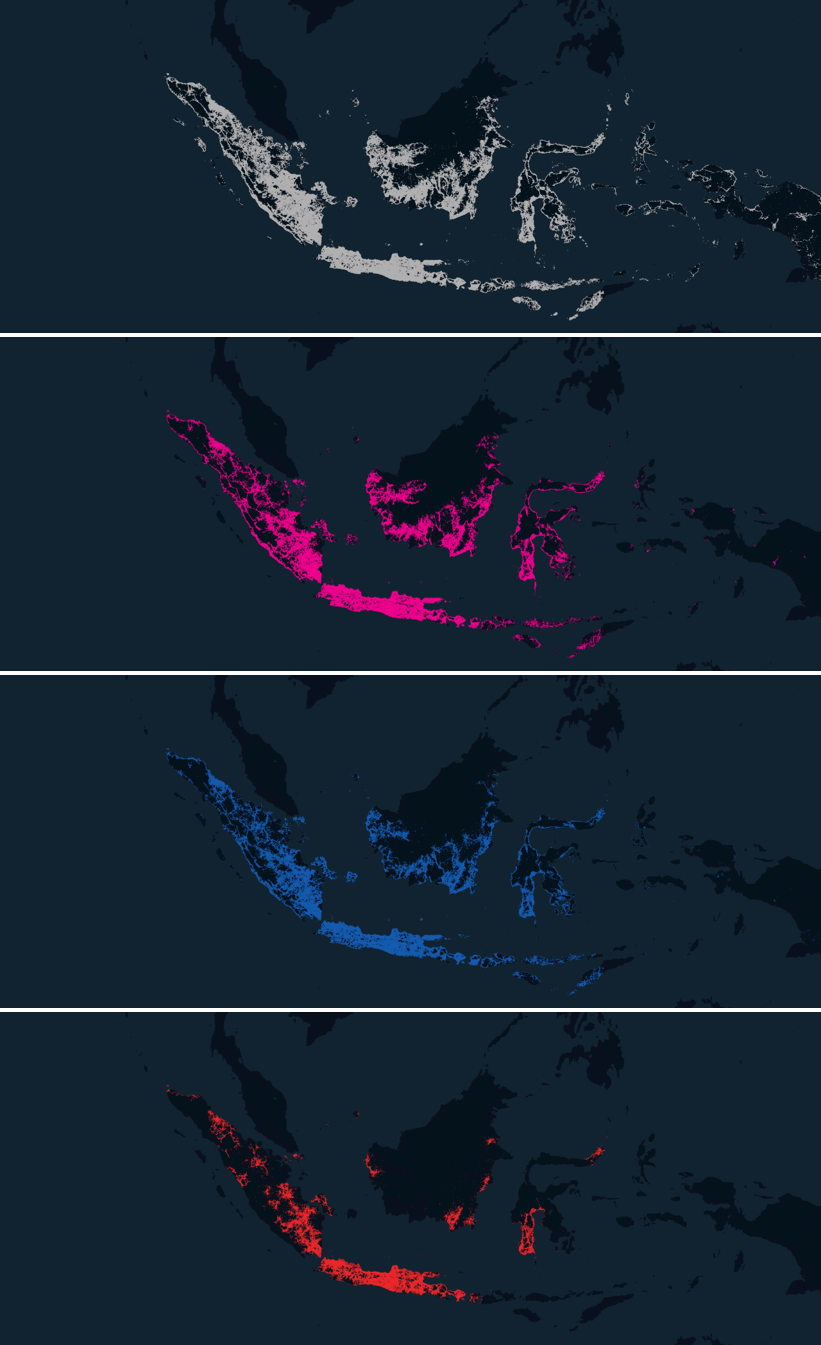

The differences in Indonesia are also present among the four main MNOs. Telkomsel covers far more area of the country than its competitors. The differences in coverage imply that Smartfren is bound to have a far greater number of BTS opportunities than its competitors.

The images show the coverage area for each MNO.

Block 1B: Degraded coverage areas in the whole territory

An estimate of the percentage of the coverage area that shows signs of degradation can be calculated. The results by zone are in the following subsection. Some global highlights are the following:

- The islands of Java and Bali have far less coverage area with degraded coverage than other islands. The difference is especially significative with Borneo, the Maluku archipelago and Papua.

- Maluku, Papua and East Nusa Tenggara have no Smartfren coverage. In other areas, Smartfren coverage is focused on less rural areas, which explains its better situation.

- Globally, Smartfren and XL are the MNOs with less degraded coverage area (24% and 32%, respectively). Telkomsel and Indosat-Three are statistically tied at around 40% of its area showing signs of degradation.

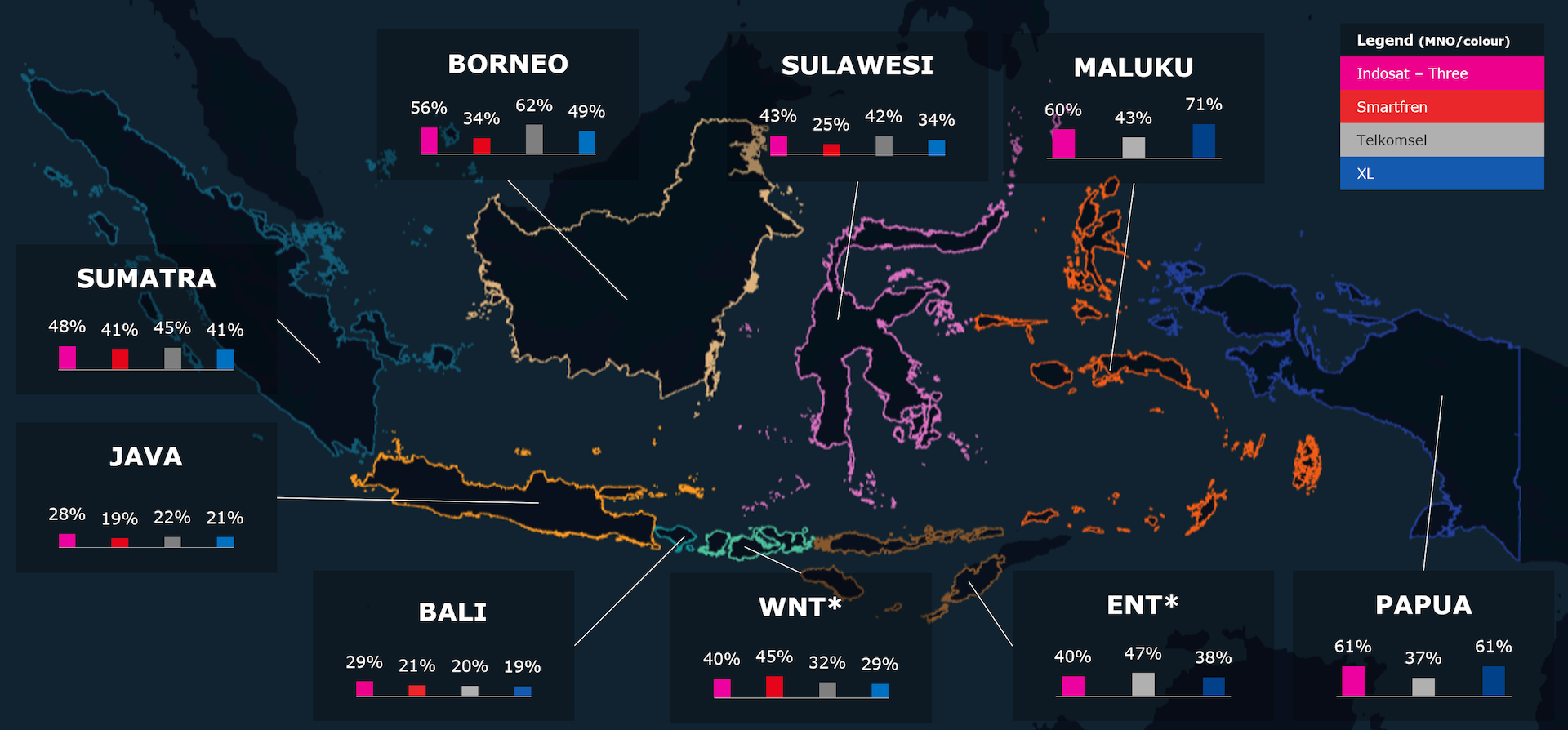

Degraded coverage areas by region

Percentage of coverage area showing degradation signs (in 4G and 5G) by MNO and region. ENT and WNT make reference to East/West Nusa Tenggara.

Block 1C: Potential co-location opportunities in the whole territory

An estimate of the percentage of the current coverage area where there could be co-location agreements can be estimated. Some global highlights are the following:

- Smartfren has no coverage whatsoever in East Nusa Tenggara, Maluku and Papua. Should they have interest in extending their network to these areas, the opportunities would be numerous. However, the talks with XL (already present in those areas) about a possible merger reduce the likelihood of Smartfren expanding its network to these regions.

- Telkomsel has a far larger possibility of providing co-location opportunities because it has the largest coverage area, whereas Smartfren has the largest possibly of receiving co-location opportunities due to its smaller coverage area.

The following chart shows in the horizontal axis the carrier providing a co-location opportunity, and in the vertical axis the MNO that would benefit from it:

Block 2: Potential BTS opportunities in urban areas

An estimate of the number of sites needed to support the already existing deployment can be calculated.

This takes into account both areas with degradation and areas where a MNO has no coverage. The results by zone are in the following subsection.

The results by zone are in the following subsection. Only urban areas have been considered, to ensure that all MNOs are compared under similar situations.

Some global highlights are the following:

- Although Bali has a coverage degradation situation similar to Java, it has potentially less BTS opportunities due to its denser deployment.

- Smartfren has no coverage whatsoever in East Nusa Tenggara, Maluku and Papua. Should they have interest in extending their network to these areas, the opportunities would be numerous. However, the talks with XL (already present in those areas) about a possible merger reduce the likelihood of Smartfren expanding its network to these regions.

- The new capital of Nusantara, in Borneo, bound to finish its first construction phase in 2024, offers room for new deployments for all carriers.

- Smartfren has more BTS opportunities because it is the MNO with the smallest coverage area.

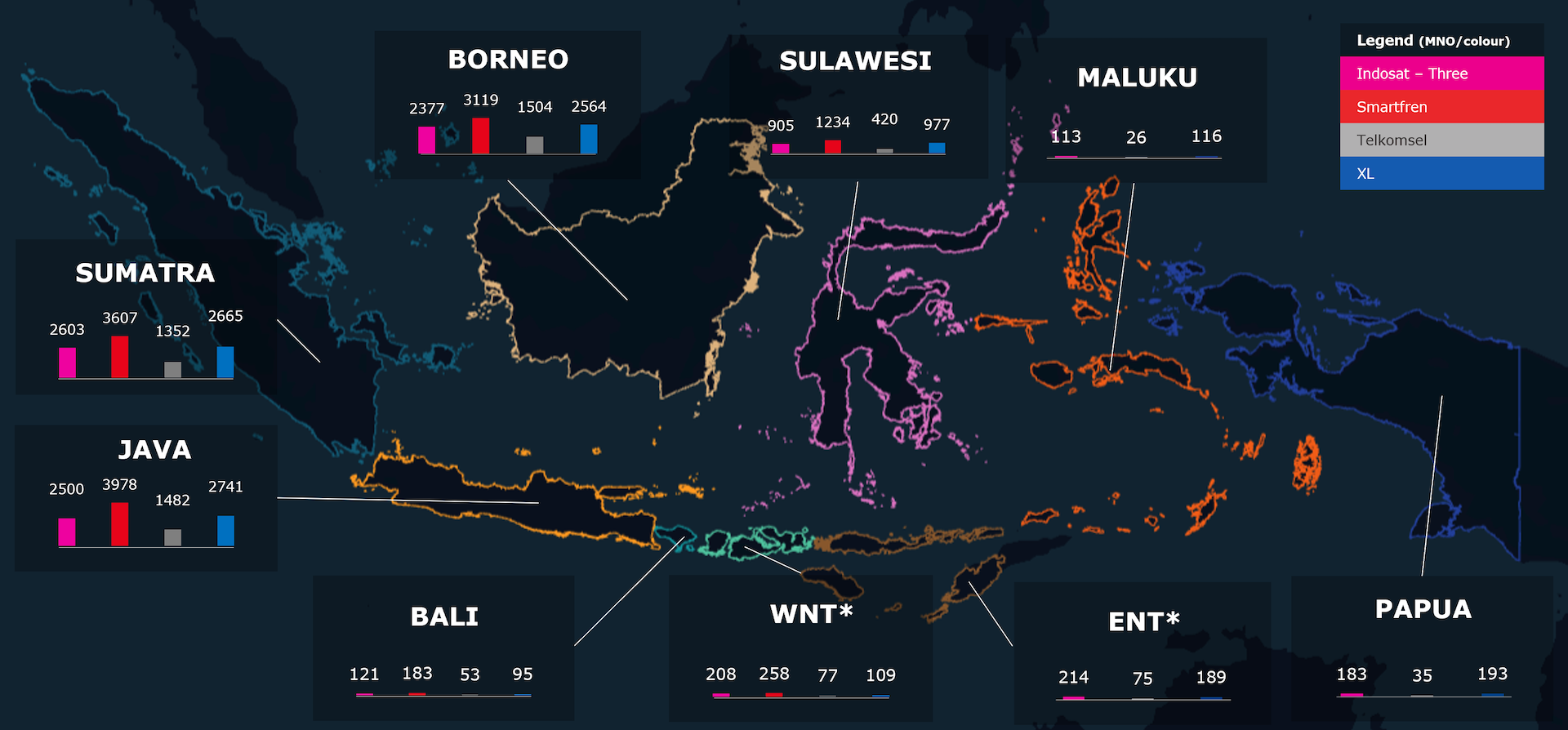

Potential BTS opportunities in urban areas by region

Number of BTS opportunities based on 4G and 5G needs by MNO and region.

Sent successfully

Email sent with unlock instructions. Please check your inbox

Error sending form

There was an error processing this request. PLease try again later

To read the report please leave us your details:

An email will be sent to your address with a link to unlock it:

The information on this report is provided as of public interest by Weplan Analytics. The information on this report is provided by Weplan Analytics solely for the user's information and it is provided without warranty, guarantee or responsibility of any kind, either expressed or implied. Weplan Analytics and its employees will not be liable for any loss or damages of any nature, either direct or indirect, arising from use of the information provided in this report. Weplan Analytics is the owner of copyright in all material or information found on this report unless otherwise stated. All contents that are published in this report are safeguarded by copyright. This copyright includes the exclusive right to reproduce and distribute the contents, including reprints, translations, photographic reproductions, electronic forms (online or offline) or other reproductions of other similar kinds. Only non-commercial use may be beyond the limitations with prior written consent. Journalists are encouraged to quote information included in Weplan Analytics reports and insights as long as clear source attribution is provided. For more information, contact [email protected]