Introduction

The Algerian mobile market comprises several operators, of which three have their own networks: Djezzy, Mobilis and Ooredoo. Regarding mobile telecommunications, MNOs are the main player of interest for TowerCos. The objective of this report is to provide a summary of the current opportunities for TowerCos in the country as a preliminary estimate.

This report provides this summary based on the following KPIs:

- Differences in coverage by MNO: not all MNOs may have the same coverage 4G and 5G along the country. Global and regional differences may help TowerCos to properly approach MNOs.

- Degraded coverage areas: areas of the country where the network (in 4G and possibly 5G) shows degradation.

- Potential co-location opportunities: co-location agreements reduce the building, installation and maintenance costs for MNOs, while improving profitability for TowerCos and optimizing space usage and resources for everyone.

- Potential BTS opportunities in urban areas: urban areas are some of the most interesting zones for performing new deployments for MNOs.

This report is divided in two great blocks:

- Block 1, with an analysis at a global level.

- Block 2, focused on BTS opportunities in urban areas, where deployments are more adjusted and optimized.

Summary

Algeria, the 2nd largest economy in North Africa, home to around 45 million people, is a growing economy with an interesting and young telecommunications market.

Three mayor players dominate the mobile market with their own networks: Djezzy, Mobilis and Ooredoo.

Mobilis, fully government owned since its creation, leads the market with around 43% of the market share. Djezzy, with the Algerian state as main stackholder since 2015 and the sole owner since 2022, follows suite with 32% of market share. Ooredoo, the local branch of the Qatari brand, with 25% of the market share, is a strong contender. This scenario makes the Algerian market a very active one.

Co-location opportunities in the whole territory

- The Algerian market experiences an extremely low rate of site sharing (around 2%). Concentrating the networks and decommissioning redounding infrastructure could be a great business opportunity.

- The area where the operator Djezzy provides coverage are the ones of highest interest to other MNOs.

Potential BTS opportunities in urban areas

- As a young network, there is ample need for new deployments in urban areas in Algeria.

- Djezzy has the highest number of BTS opportunities, whereas Mobilis (the first MNO in the country) has the least number BTS opportunities.

- All MNOs, however, exhibit great number of BTS opportunities.

Methodology

Under this section an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

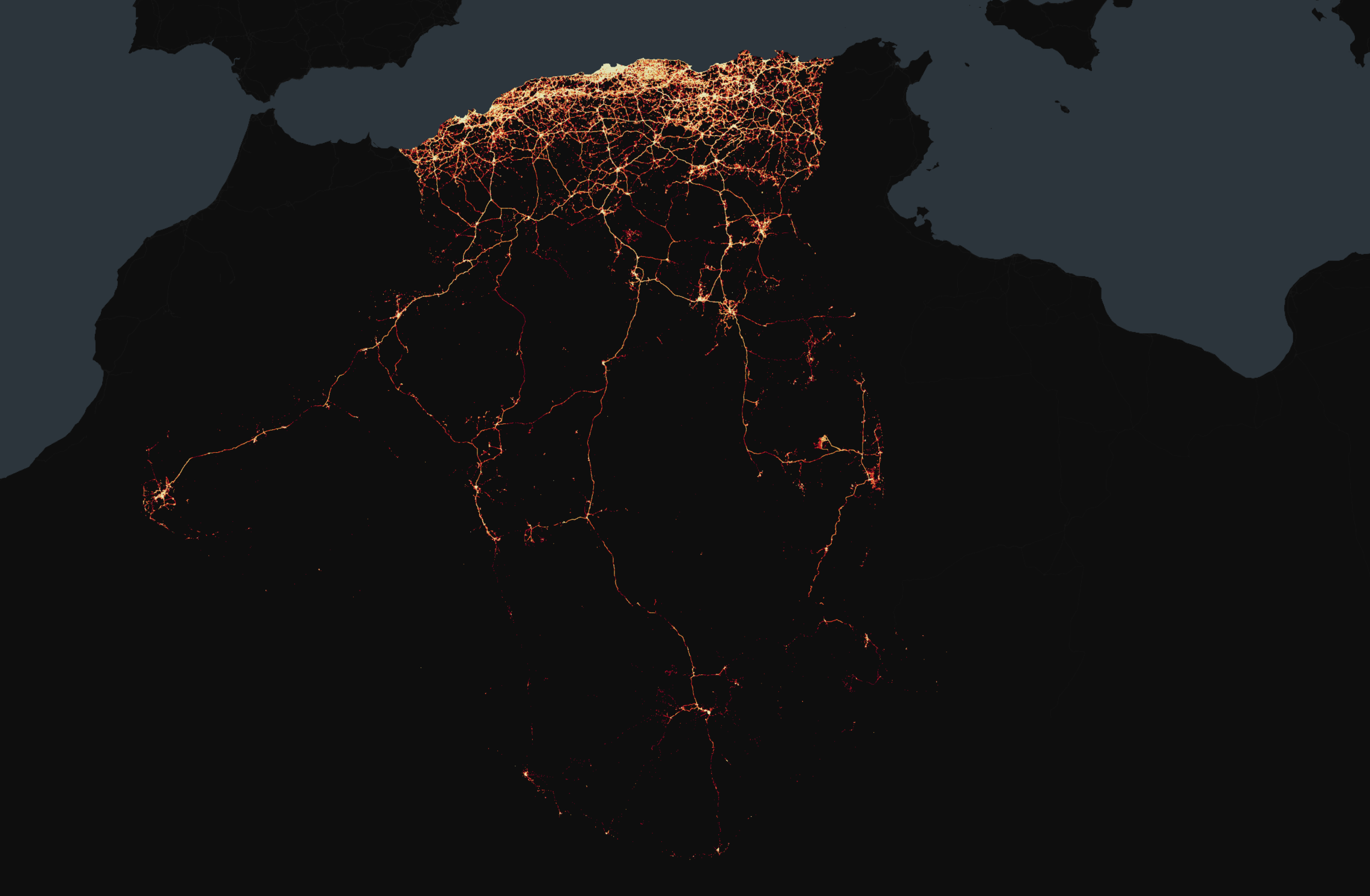

At a more general level, Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 727 million measurements collected between October and December 2023 were used.

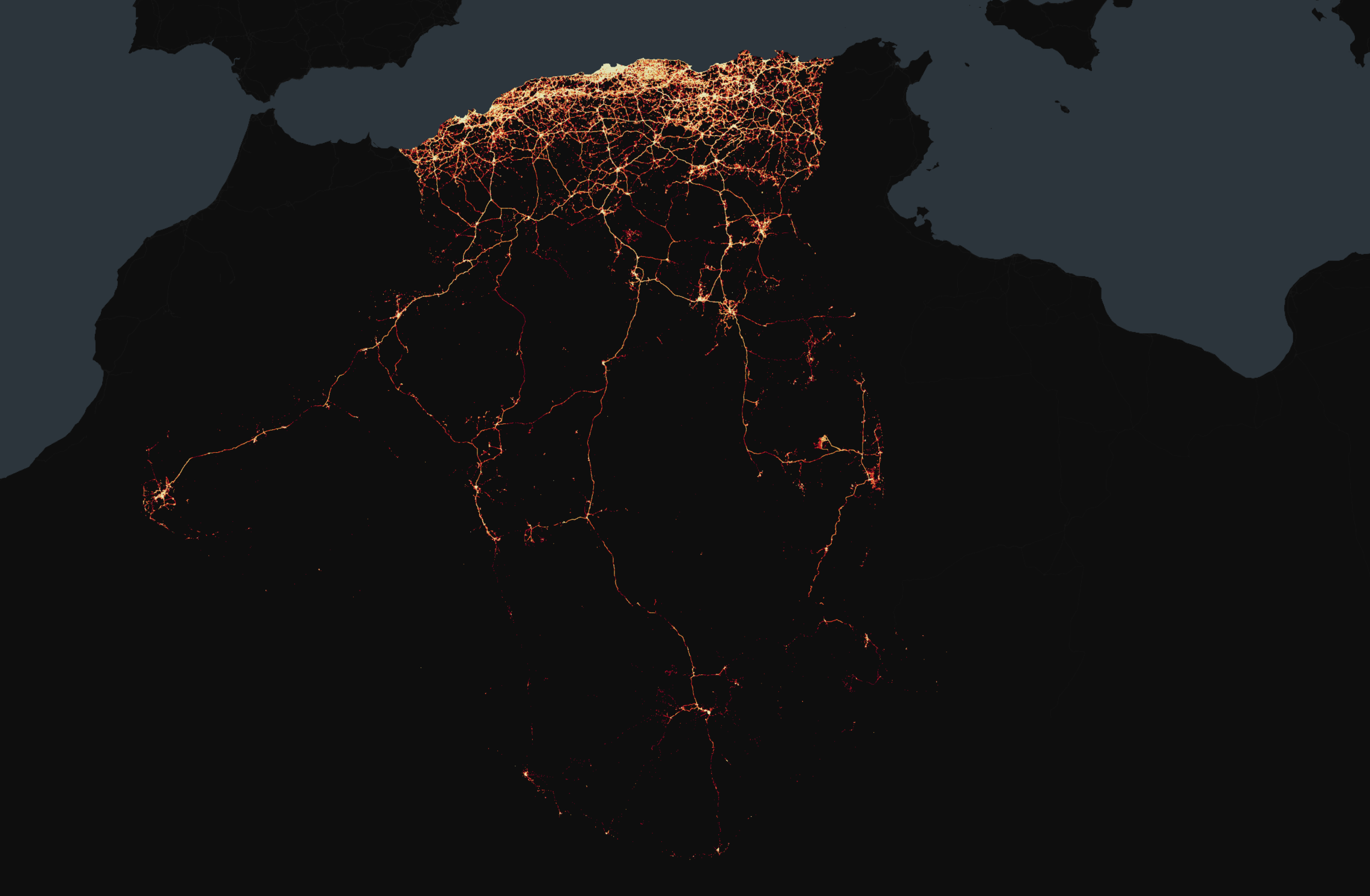

The following map shows the density of measurements taken throughout Algeria by Weplan Analytics.

The most relevant insights can be found in the Summary section above. A detailed account of each one comprises the rest of the report below.

As the three aforementioned MNOs serve their networks to other parties (such as VMNOs, due to roaming agreements or as part of emergency coverage) they have been filtered by the network provider reported in the SIM card.

More details about the methodology can be found here.

Block 1A: Differences in coverage by MNO in the whole territory

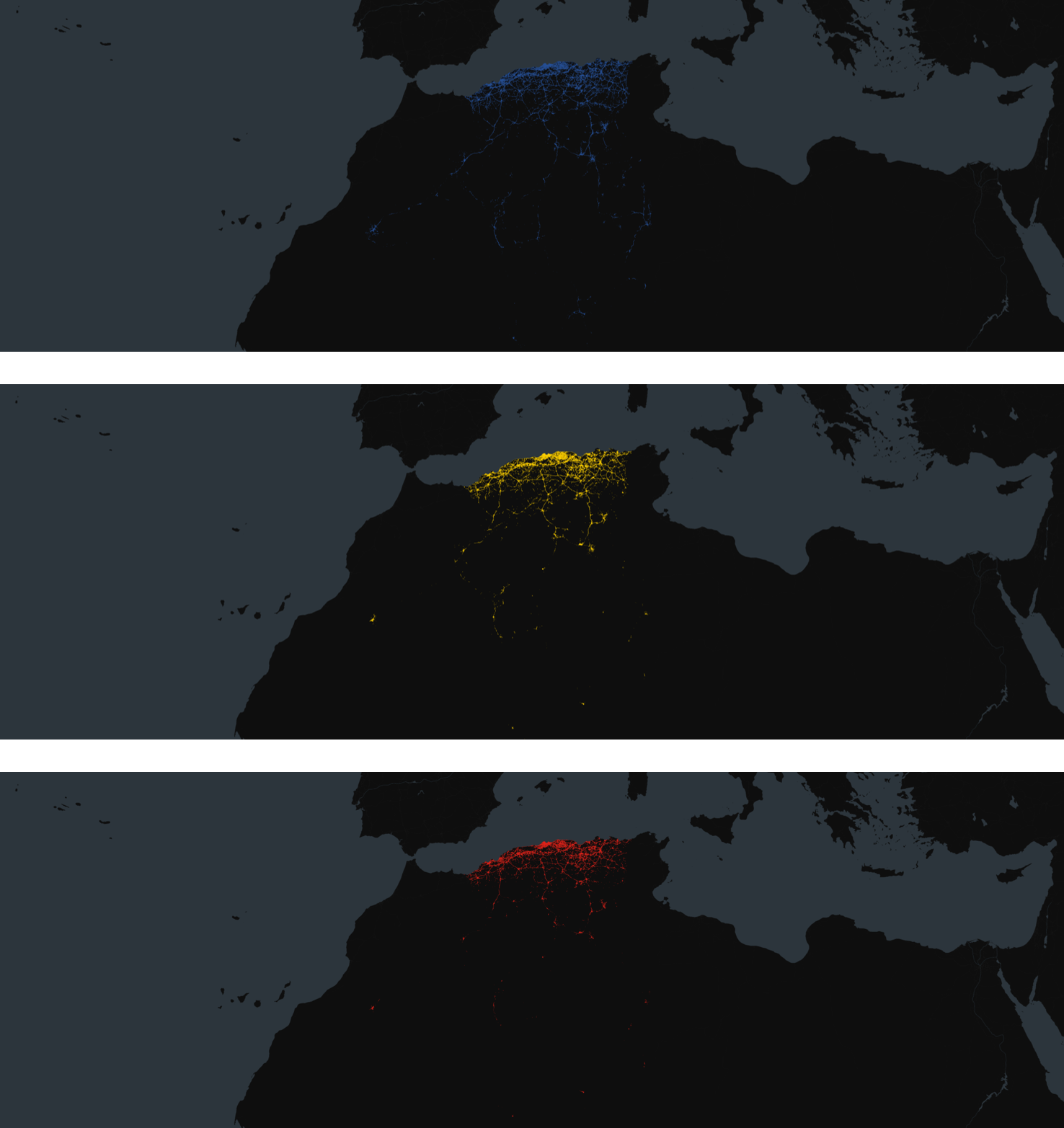

Mobilis has a more extense coverage area than its competitors. This difference in coverage means that Djezzy has the most potential for BTS opportunities.

The images show the coverage area for each MNO.

Percentage of covered area compared to Mobilis (Mobilis is the reference at 100%)

Block 1B: Degraded coverage areas in the whole territory

An estimate of the percentage of the coverage area that shows signs of degradation can be calculated. Some global highlights are the following:

- Globally, Djezzy is the carrier with less percentage of its coverage area showing signs of degradation (around 19%).

- Mobilis and Ooredoo are nearly tied with 29% and 28% of their area, respectively, showing signs of degradation.

Percentage of degraded coverage area in all Algeria by MNO

Block 1C: Potential co-location opportunities in the whole territory

An estimate of the percentage of the current coverage area where there could be co-location agreements can be estimated. Some global highlights are the following:

- Less than 2% of the sites in Algeria are being shared. Thus, there is great room for concentration and optimization of the existing network deployment.

- The areas where Djezzy has infrastructure are the most attractive to other MNOs.

- The areas where Mobilis and Ooredoo are located are similar in their interest to their competitors, with the ones of Mobilis being slightly more interesting.

The following chart shows in the horizontal axis the carrier providing a co-location opportunity, and in the vertical axis the MNO that would benefit from it:

Block 2: Potential BTS opportunities in urban areas

A downward estimate of the number of sites needed to support the already existing deployment can be calculated.

This takes into account both areas with degradation and areas where a MNO has no coverage.

Only urban areas have been considered, to ensure that all MNOs are compared under similar situations.

Some global highlights are the following:

- As a young network, there is ample need for new deployments in urban areas in Algeria.

- As the MNO with the smallest coverage area, Djezzy has the highest number of BTS opportunities. Ooredoo has a similar number of opportunities.

- On the other hand, Mobilis (the first MNO in the country and the one with the largest coverage area) has the least number BTS opportunities.

- All MNOs, however, exhibit great number of BTS opportunities: a minimum of 160 and a maximum of 207.