Introduction

In France there are 4 main MNOs with their own network: the Bouygues Telecom, Free, Orange and SFR. The network situation for these MNOs acts as a trustworthy barometer of the network situation in the country. A good knowledge of the network situation also allows the customers to perform fully informed decisions. The objective of this report is to provide a summary of the network situation in France for these four carriers.

This report provides a quick overview of the network situation based on the following KPIs:

- Disconnection time: time that the users of an MNO have had only emergency coverage or no coverage in average, in minutes.

- 4G and 5G time: percentage of time that the users of an MNO have had 4G and, if deployed, 5G coverage (including 5G NSA and 5G SA).

- 5G penetration and usage: percentage of users that have 5G connectivity and the percentage of time that 5G is actually used.

- Network status in the Common Coverage Area: an analysis of the network status, based on the signal strength and the signal quality, for the areas where all four MNOs provide coverage.

- Call technology usage: percentage of use of each call technology by MNO. This shows which technologies are mainly used by the customers.

- Mobile network latency: percentage of customers on different latency ranks. The ranks are selected according to several performance thresholds.

Summary

The data collected by Weplan Analytics shows that, overall, all four main MNOs have a good network situation in France, with very similar performance among them. There are, however, some notable differences, between the MNOs.

Compared to its competitors, Free stands out in several categories, exhibiting a less optimal latency: only 40% of the measurements were excellent, whereas the other MNOs have between 60% (the case of Bouygues Telecom) and 62% (the case of SFR) of their measurements with excellent latency. Regarding phone calls, Free users make far less usage of VoLTE technology than other MNO’s clients, resorting to CSFB 3G in nearly 80% of their calls. On the other hand, Free provides more 5G coverage time to its 5G clients (66% of the time) while its competitors provide between 49% and 55% of the time.

Among all the carriers, the performance of Orange is above the rest regarding network status, both when considering it area-wise and measurement-wise. Regarding this aspect, Free and SFR show a slight disadvantage compared to Bouygues and Orange, with more areas and measurements showing signs of network degradation on their 4G and 5G networks.

The main key figures are the following:

- The four main MNOs (Bouygues Telecom, Free, Orange and SFR) in France provide 4G or 5G coverage to their customers more than 90% of the time.

- On average, 12% of all clients for all analyzed MNOs are 5G clients.

- Among the 5G customers, Free leads the 5G usage time with 66% of 5G usage. The other MNOs have between 49% and 55% of 5G usage time.

- Around 90% of measurements for all carriers have a latency good enough for a decent experience on every possible usage type.

Methodology

In the following pages an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

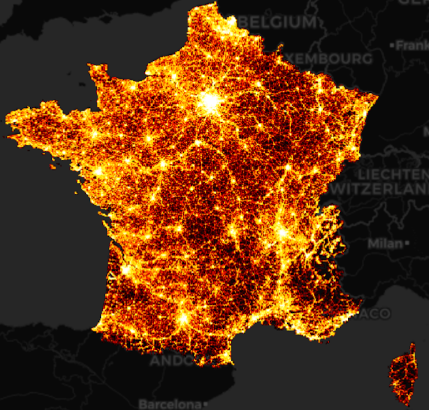

Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 2,984 million measurements collected between November 2022 and January 2023 were used. This report only features data regarding Metropolitan France. Overseas Departments and Regions (DROM, départements et régions d’outremer) are not included and may present vastly different situations. The following map shows the density of measurements taken throughout the country by Weplan Analytics.

As these MNOs serve their networks to other parties (such as VMNOs, due to roaming agreements or as part of emergency coverage) the following criteria to analyze each MNO were followed:

- Bouygues Telecom has been filtered by the SIM BOUYGUES TELECOM.

- Free has been filtered by the SIM FREE. It is worth noting that Free has a roaming agreement with Orange in 2G and 3G.

- Orange has been filtered by the SIM ORANGE.

- SFR has been filtered by the SIM SFR.

You can find more details about the methodology at this link.

Connectivity

Connectivity: Disconnection time

The following table and graphic show the disconnection time as the average daily minutes that a MNO has experienced disconnection. Disconnection time includes moments when a customer has no coverage at all (for example in underground parkings, inside elevators, so far away from a site that connection is not possible...) or moments when a customer only has emergency coverage, that is, the ability to perform only emergency calls.

The MNO with the least disconnection time is Orange, having a statistical tie with SFR. The third and fourth place respectively are occupied by Bouygues and Free. Overall, however, users of the four MNO spend only 1% or less of their time without coverage. This means that, on average, users lack proper connection between 11 minutes (the case of Orange and SFR) and 17 minutes a day (the case of Free). This disconnected time may (and, in most cases, will) be discontinuous.

Connectivity: 4G and 5G time

With the advent of the newer 5G technology older technologies such as 2G and 3G are being turned off to free frequencies. Thus, guaranteeing at least a proper 4G coverage is one of the main goals of MNOs, and for those who already have 4G sorted out, the focus turns to 5G.

In France, all MNOs have good 4G and 5G coverage, surpassing the 90% of coverage in those technologies. Bouygues, Orange and SFR lead the coverage time in 4G and 5G, all three sharing a top position with 96% of their coverage time under the newest technologies. Free follows closely with a 92% of 4G and 5G coverage time. The following figure shows these values.

5G penetration and usage

The start of 5G deployment in France took place in November 2020. All the four main MNOs started deploying 5G from that date onwards. Free has conducted the most aggressive deployment campaign, with their competitors following more conservative approaches.

The ability of a customer to use the 5G network depends on several factors. First, their device must be 5G compatible. Second, the MNO must have a 5G network. Finally, the client must contract a mobile plan that allows the 5G to be used, as not all MNOs offer full access to the 5G network as part of the regular plans. The following charts show the percentage of users by MNO that have 5G access and, for those who do, the percentage of time that they use 5G. To establish whether a user is a 5G client or not, their 5G connectivity has been checked: if they have connected to the 5G network at least once, they are considered 5G clients.

All the companies have very similar figures regarding 5G clientele, with Bouygues and Free leading with 14% of their clients being 5G clients, followed by SFR (11%) and Orange (10%).

Regarding 5G usage, however, there is a clear leader: Free, providing 5G to their clients 66% of their coverage time. The other MNOs lag far behind in similar positions, with Bouygues having a 55% of 5G time, SFR having a 53% of 5G time and Orange having a 49%.

4G and 5G network status

There are two main network performance indicators: signal strength and signal quality. Each technology has its own measurements, but five great categories can be established:

- Very Good: the performance for all network usages will be excellent.

- Good: the performance for all network usages may present occasional difficulties but is overall good.

- Fair: most network-dependent usages (such as calls or data usage) will have a decent or better performance.

- Degraded: network usage will be unstable and unreliable but allows for basic usage such as calls with acceptable quality and very slow data transfer.

- Very Degraded: network usage different from emergency calls is nearly impossible.

There are two ways to establish this value: looking at the percentage of area and looking at the percentage of measurements on each category. Most measurements take place in urban areas, where coverage is better, but in most countries most of the area is not urban, so the percentage of area with a problematic network situation may be different to the percentage of measurements with a problematic network situation. To ensure a fair comparison between carriers only areas where all MNOs have data have been analyzed. Also, as most connections are made in 4G and 5G, only those technologies have been considered.

As can be seen, Orange leads the percentage of area with Very Good situation, and Free and SFR are the ones with less area covered guaranteeing full data usage. However, in both extremes the percentages are very similar for all carriers. Overall, all carriers have a very similar situation, guaranteeing access to at least calls in nearly all the territory.

Looking at measurements instead of area the overall situation is very similar: at least 95% of the measurements had enough signal strength to allow basic calls in 4G and 5G, and at least around 65% of the measurements had enough signal strength (fair and above) to guarantee decent data usage.

The percentages in both extremes are higher when looking at the events level rather than at the area level. This is not strange: it is easier to find really good or really bad measurements than really good or really bad zones (that is, where most of the measurements are really good or really bad).

Call type percentage

Although 2G and 3G are capable of data usage, the advent of 4G and more recently 5G technologies have relegated them to mostly call usage. The absence of 4G-based call technology ensured that 2G and 3G, as the only way to make a phone call, were still relevant. The development of VoLTE (Voice over LTE) calls during the 2010s marked the beginning of the end for these legacy technologies.

However, not all customers can benefit from VoLTE calls. For a customer to use this technology several conditions must be met:

- Their MNO must provide 4G and VoLTE.

- They must have a phone capable of performing VoLTE calls and a phone rate that includes VoLTE calls.

- Their phone must be homologated by the MNO and the manufacturer to perform VoLTE calls.

The last condition means that a customer, without changing their phone, can have VoLTE with one MNO but lack it with a different MNO. When a customer connected to 4G without VoLTE capabilities (for any reason) tries to perform a call, a hand-off process to the 2G or 3G network takes place. This process, depending on the method applied, is called CSFB (the most common one) or SRVCC. Aside from those technologies, VoWiFi (Voice over Wi-Fi) is also used when a Wi-Fi network is available.

The previous chart shows the usage of each technology (as a percentage of total usage) by MNO. It is clear that, except for Free, all MNOs have their customers use VoLTE around 60% of time. The second most used technology is 3G, both directly and via a network transfer (CSFB). The overall low use of 2G is remarkable, as is one of the drivers behind the decision to shut down 2G before 3G as part of the process of turning off obsolete networks in France.

Latency status

Latency is the measurement of how much time it takes for the information to be transmitted between the user and the network. A lower latency means a faster, smoother network experience, whereas a higher latency means that the network experience will not be as good, or even unusable. This makes latency a good indicator of user experience. We have divided latency in four great groups:

- Excellent latency translates to a very smooth user experience, even with the most data-intensive usage, such as gaming or 4K streaming.

- Good latency translates to a good user experience, although gaming may not be as fluid and 4K may present occasional problems.

- Degraded latency translates to a mediocre user experience. Gaming and 4K are either uncomfortable or impossible, videochat may present noticeable lag, messaging with multimedia may take a long time to load and loading a web may be slow.

- Bad latency translates to an essentially unusable network. Only the lightest usage, such as sending messages without multimedia works decently.

The previous chart shows the latency situation in France. The lower categories behave similarly for all MNOs. The main difference lies in the higher categories between Free and the other three MNOs: only 40% of measurements taken from Free’s network have an Excellent latency, whereas the other MNOs round the 60%.

Sent successfully

Email sent with unlock instructions. Please check your inbox

Error sending form

There was an error processing this request. PLease try again later

To read the report please leave us your details:

An email will be sent to your address with a link to unlock it:

The information on this report is provided as of public interest by Weplan Analytics. The information on this report is provided by Weplan Analytics solely for the user's information and it is provided without warranty, guarantee or responsibility of any kind, either expressed or implied. Weplan Analytics and its employees will not be liable for any loss or damages of any nature, either direct or indirect, arising from use of the information provided in this report. Weplan Analytics is the owner of copyright in all material or information found on this report unless otherwise stated. All contents that are published in this report are safeguarded by copyright. This copyright includes the exclusive right to reproduce and distribute the contents, including reprints, translations, photographic reproductions, electronic forms (online or offline) or other reproductions of other similar kinds. Only non-commercial use may be beyond the limitations with prior written consent. Journalists are encouraged to quote information included in Weplan Analytics reports and insights as long as clear source attribution is provided. For more information, contact [email protected]