Traveling on the Spanish High-Speed Train (AVE) is synonymous with speed, comfort, and punctuality. But when it comes to mobile connectivity, the experience doesn’t always match up: impossible video calls, apps that stop loading, and long stretches without signal.

To understand exactly where and how much coverage fails, we analyzed six months of crowdsourced data across the entire Spanish AVE network (June - November 2025). The result is an analysis that highlights the spots where even the best available operator doesn’t provide sufficient quality.

How we measured it

The analysis focuses exclusively on the tracks used by the AVE. We included all SIMs collecting data on these routes but classified them according to the three operators that actually provide mobile networks: Movistar, MásOrange, and Vodafone.

For each official segment (as defined by CNIG), we calculated the best 4G and 5G coverage percentage, equivalent to the share of time with non-deficient coverage, following CNMC criteria and considering only 4G or 5G measurements.

We selected the operator with the best results for each segment. This way, we can see the real maximum coverage possible in that location. If even the best operator is struggling, it indicates a problematic spot.

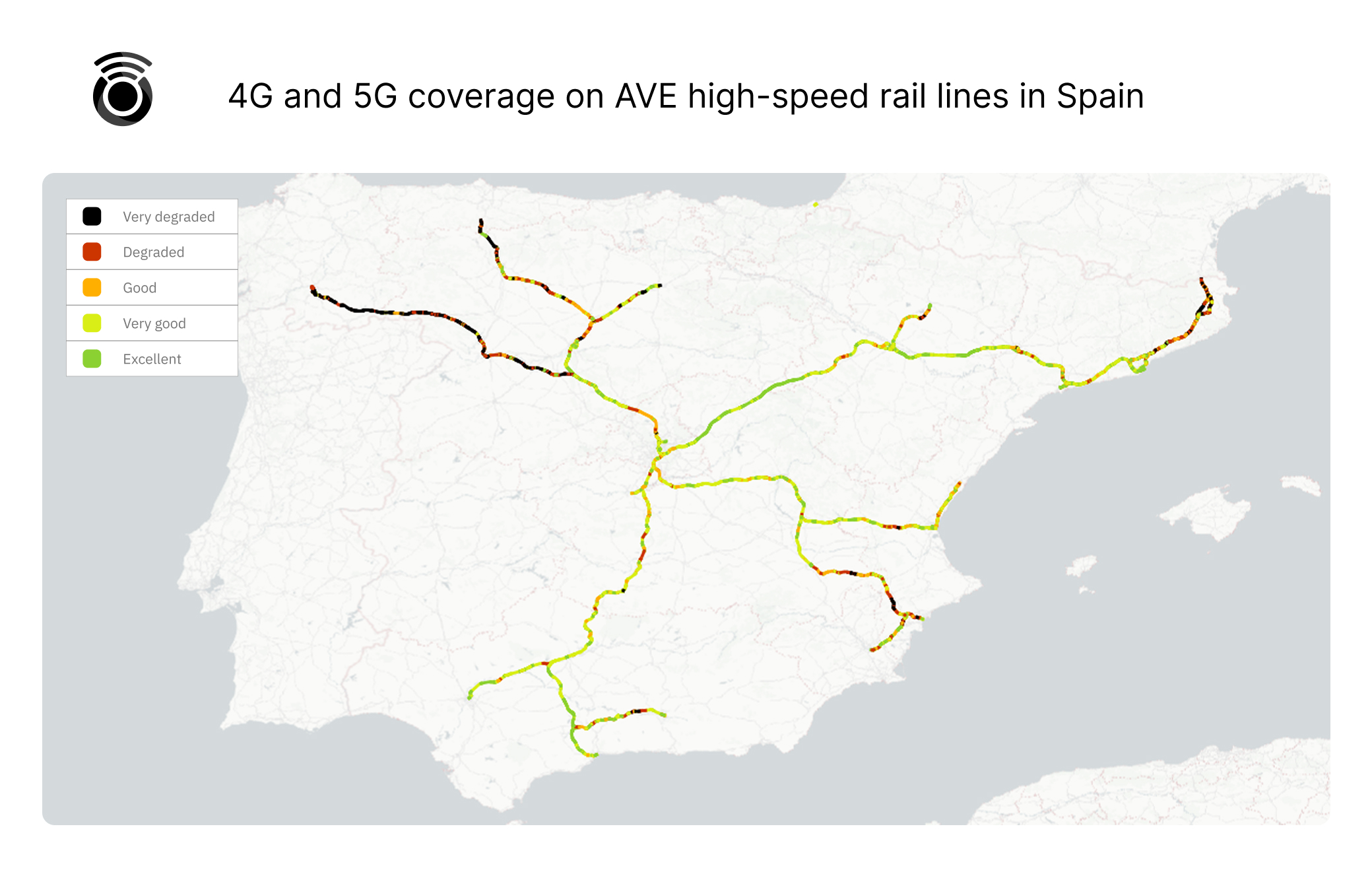

A section is said to have Degraded coverage if less than 50% of the time there is non-deficient coverage; Decent if it has non-deficient coverage more than 50% of the time; Solid if it has non-deficient coverage more than 75% of the time; and Very Solid if it has non-deficient coverage more than 85% of the time.

How much 4G/5G coverage is actually available on the AVE?

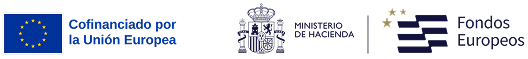

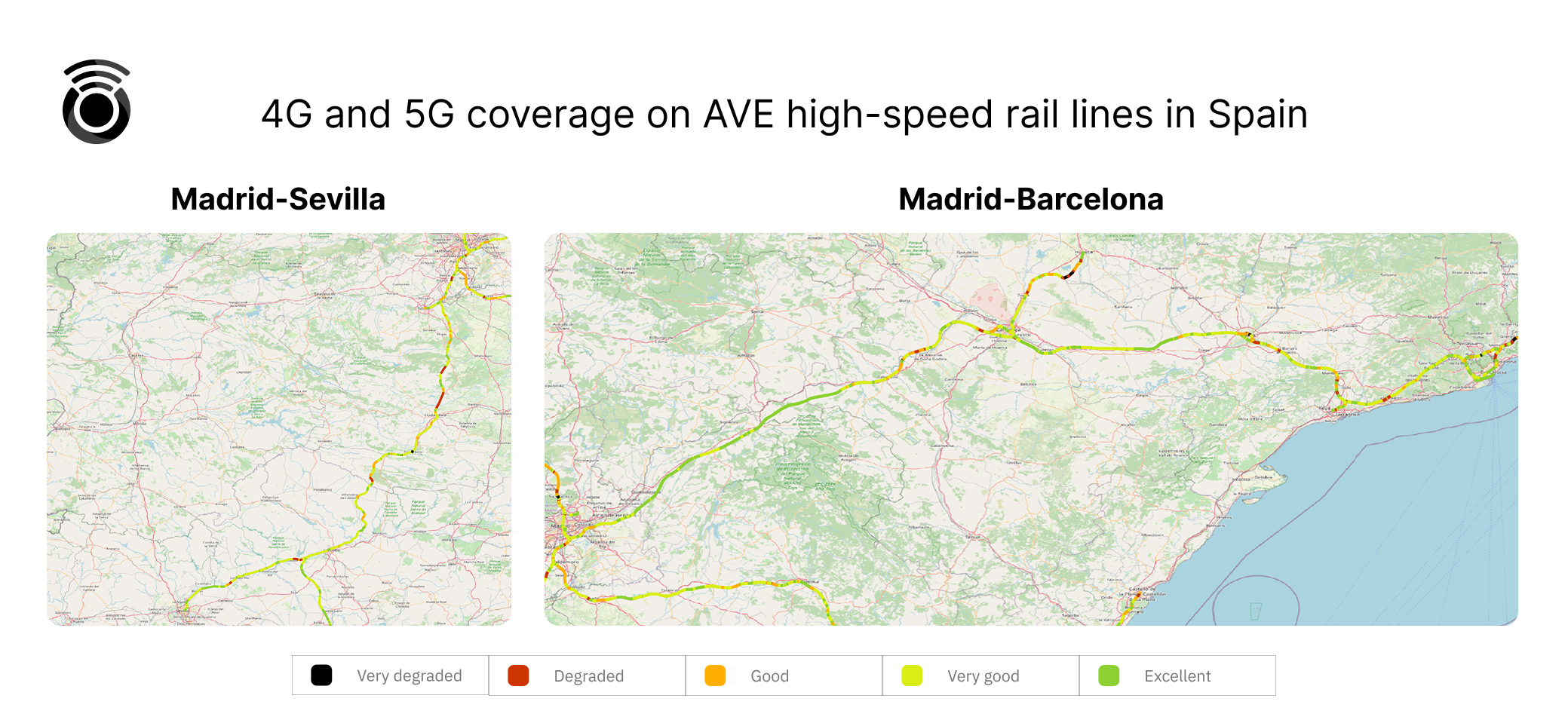

The 4G and 5G rollout is extensive but still uneven: some stretches provide comfortable connectivity, while others show much more limited performance.

We can see how coverage behaves across the high-speed network, understanding segment by segment where the signal stays strong and where interruptions may occur:

- On nearly the entire route —around 90% of the journey— you’ll have enough 4G or 5G to use apps without worrying about major interruptions.

- On three-quarters of the network, the connection is clearly stable and fast — ideal for streaming, remote work, or short video calls.

- On just over half of the route, modern coverage performs really well. On these segments, you can do almost anything you would with a good connection on land.

Problematic segments

Mapping these metrics reveals a clear pattern: lines heading north are the most affected.

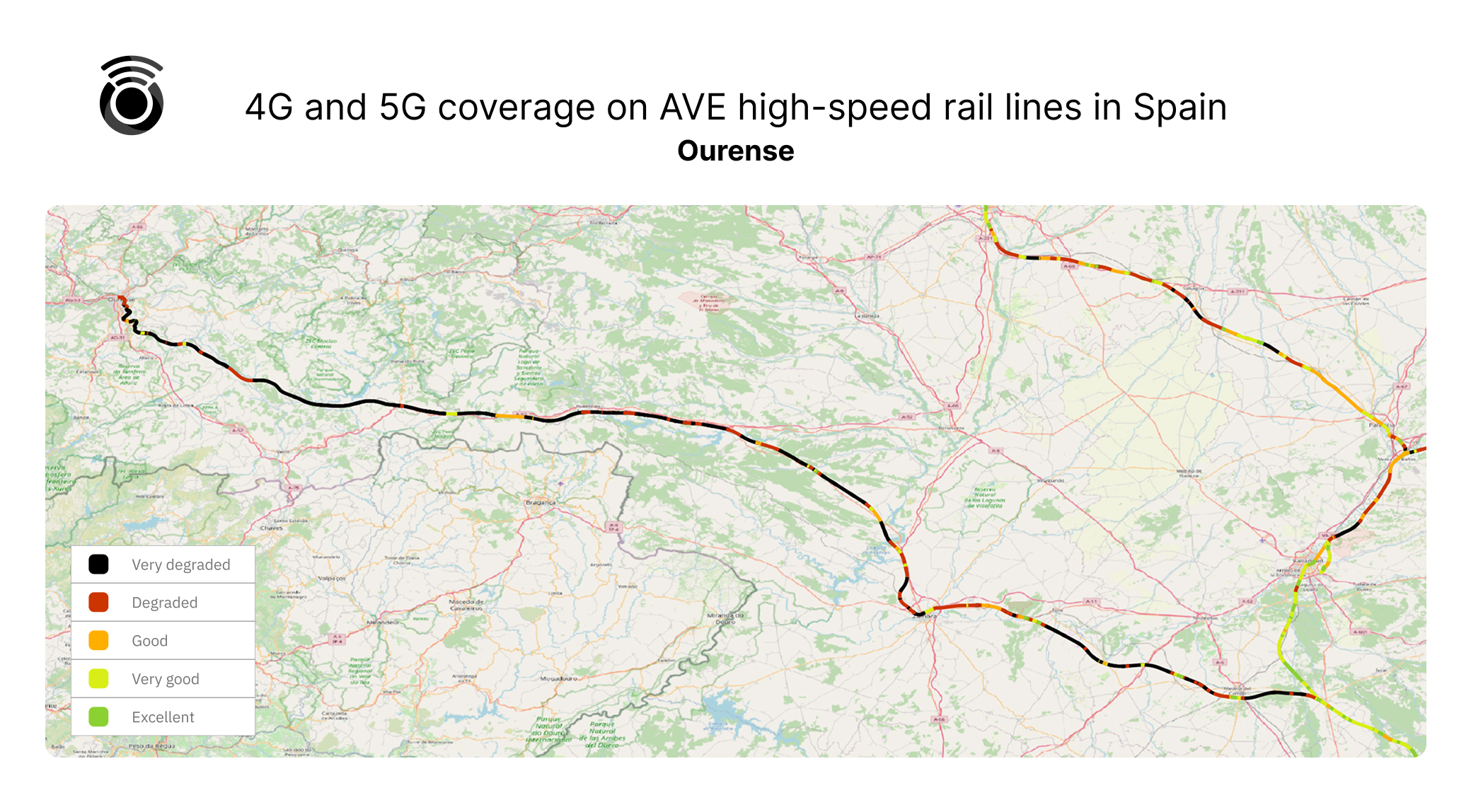

Madrid–Ourense: the epicenter of the problem

This route shows the worst performance, with large areas in black and red. In many spots, when the signal appears, it seems more a matter of luck than a solid network. The segment branching towards Galicia is especially critical.

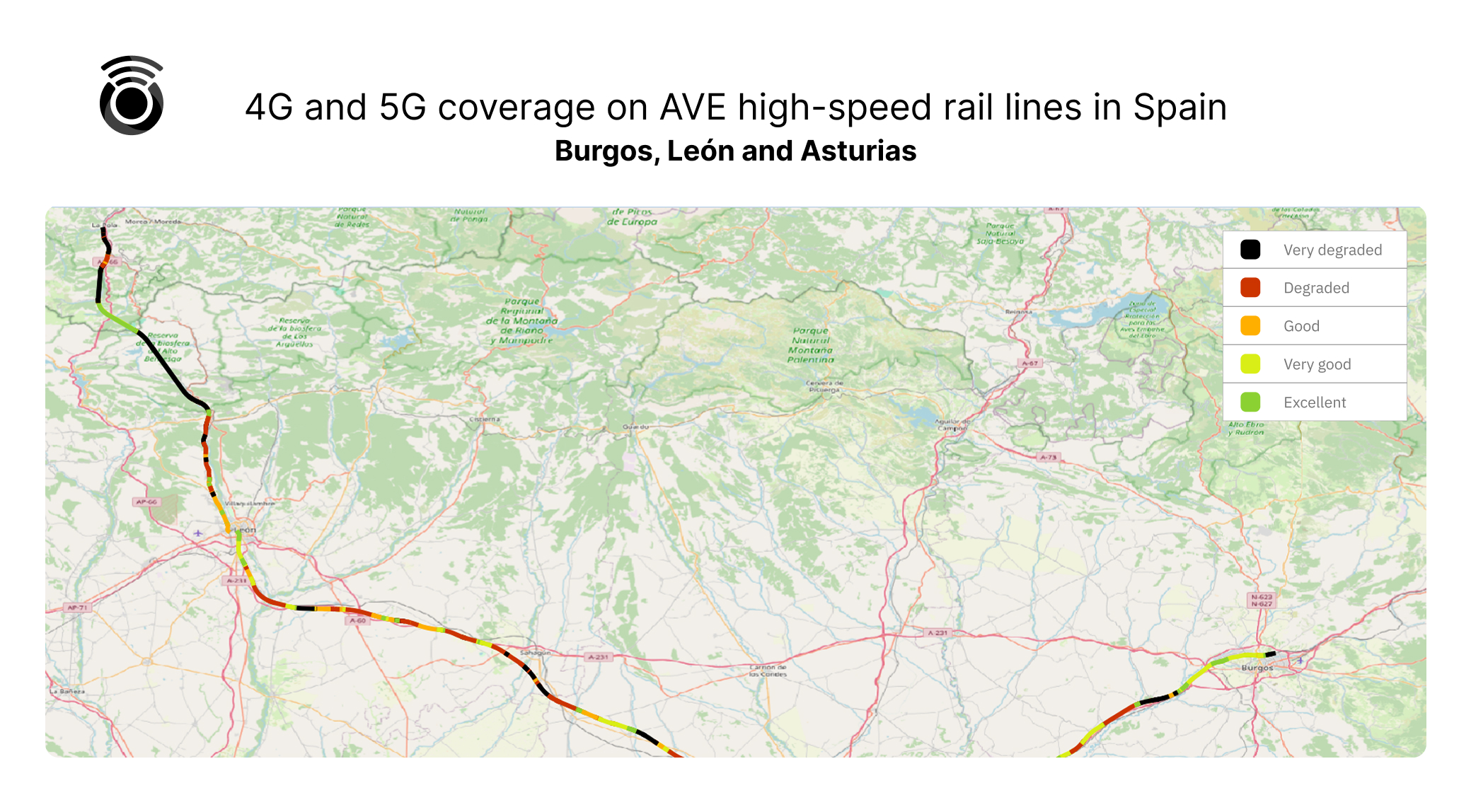

Burgos, León and Asturias

These areas have long stretches with significant degradation. Difficult terrain and tunnels contribute heavily.

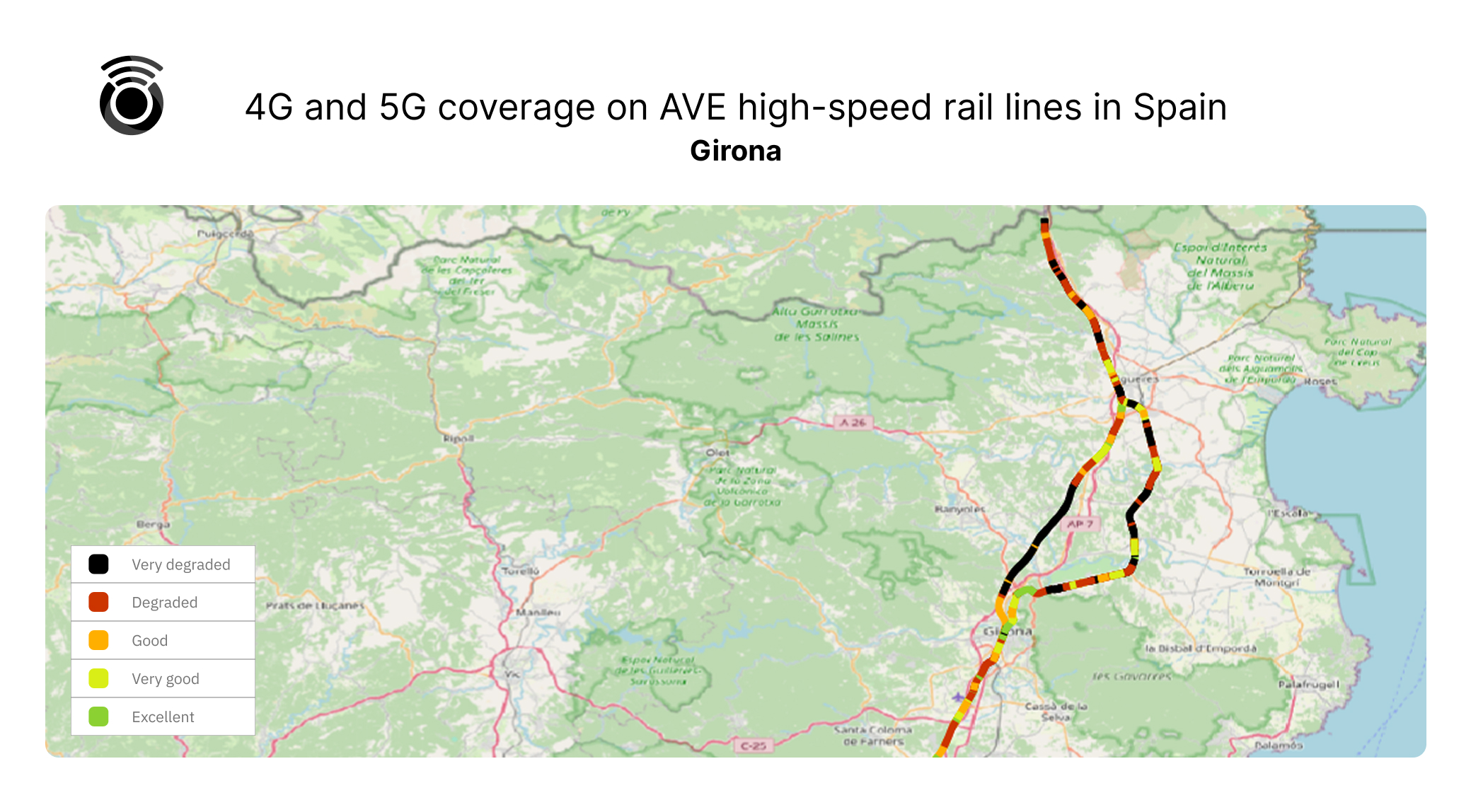

Branches toward Granada, Alicante, or Girona

Although not considered main axes, they show weak coverage points that stand out compared to the more established lines. For example, part of the Girona segment illustrates this clearly.

In contrast, lines like Madrid–Barcelona or Madrid–Seville maintain much more continuous and predictable coverage.

And remember: we are always talking about the operator that performs best in each segment. If your SIM relies on a different operator, real coverage may be worse.

What this means for travelers

Average connectivity on the AVE is good, and on most routes, you can browse, use apps, or send messages without major issues.

However, if you’re traveling to Galicia, León, Asturias, or Burgos, or on some branches like Granada, Alicante, or Girona, you may experience prolonged interruptions or complete signal loss.

The good news is that these crowdsourced data allow us to pinpoint the most critical points accurately. And that opens the door to future improvements that could bring connectivity up to the same level as the train’s speed.

This report is distributed as a public interest report by WePlan Analytics. The information in this report is provided by WePlan Analytics for information purposes only and is provided without warranty or liability of any kind, either express or implied. WePlan Analytics and its employees shall not be subject to any liability whatsoever for any loss or damage, direct or indirect, resulting from the use of the information in this document. WePlan Analytics is the copyright owner of all material and information contained in this report unless otherwise noted. The entire contents of this report are protected by copyright. This copyright includes the exclusive right of reproduction and distribution, including reprints, translations, photographic reproductions, electronic formats (online or offline) or other reproductions of a similar nature. Only non-commercial use, with prior written permission, may be considered excluded from the above limitation. Journalists and reporters are encouraged to cite information included in WePlan Analytics reports and analytics as long as the source of the information is clearly stated. For more information, contact [email protected]