Introduction

The Emirati mobile market comprises several operators, of which two have their own networks with nation-wide coverage: Du and Etisalat. Thus, the network situation for these MNOs acts as a trustworthy barometer of the network situation in the country. A good knowledge of the network situation also allows the customers to perform fully informed decisions.

The objective of this report is to provide a summary of the network situation in United Arab Emirates for these two carriers.

This report provides a quick overview of the network situation based on the following KPIs:

- Disconnection time: daily average minutes that the users from a MNO have had only emergency coverage or no coverage.

- 4G and 5G time: percentage of time that the users from a MNO have had 4G and, if available, 5G coverage (including 5G NSA and 5G SA).

- 5G penetration and usage: percentage of users that have 5G connectivity, and percentage of time in 5G.

- Network status in the Common Coverage Area: an analysis of the network status, based on the signal strength and the signal quality, for the areas where all two MNOs provide coverage.

- Mobile network latency: percentage of customers on different latency ranks. The ranks are selected according to several performance thresholds.

Summary

The data collected by Weplan Analytics shows that, overall, the two main mobile network operators have a good network situation in United Arab Emirates. However, there are some differences between them.

In terms of connectivity, the two operators have very similar disconnection times, with Du having 6 minutes of limited connectivity or disconnection per day and Etisalat reaching 7 minutes of disconnection a day. It is relevant to highlight that all three operators offer 4G/5G coverage at least 96% of the time, which highly guarantees the quality of service provided by these operators.

These Emirati operators offer good coverage. Regarding areas of "Good" or "Very Good" network, Du leads the list with 54% of its covered area with good or very good coverage, followed by Etisalat with 51%. It must be kept in mind that these figures make reference to the common coverage area.

In terms of 5G penetration and usage, neither operator stands out over the other, as Du has 18% of users with 5G capability, and Etisalat has 17%. However, Du provides 5G coverage 26% of the time, while Etisalat does so 22% of the time.

Finally, in terms of latency, Etisalat stands out over its competitor with 42% of measurements with excellent latency, while Du has only 26% of measurements with excellent latency.

The main key figures are as follows:

- The main operators in United Arab Emirates, Du and Etisalat, offer 4G and 5G technology coverage at least 96% of the time.

- Between 17% and 18% of the customers from the analyzed operators are 5G customers (i.e. customers who have a device compatible with 5G technology) and can access it, on average, around 24% of their coverage time.

- On average, 58% of all MNOs' measurements have a latency good enough to offer an adequate experience for every possible use.

Methodology

In the following pages an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

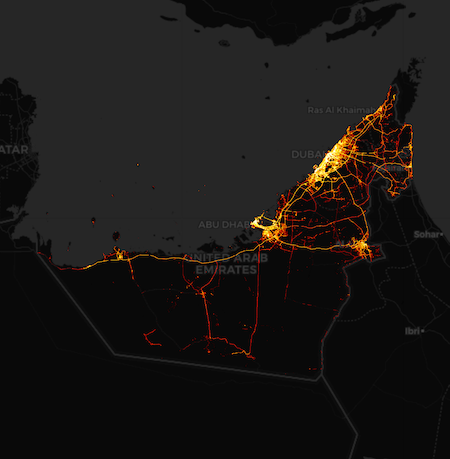

At a more general level, Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 66 million measurements collected between october and december 2023 were used.

The following map shows the density of measurements taken throughout United Arab Emirates by Weplan Analytics.

The most relevant insights can be found in the Summary section above. A detailed account of each one comprises the rest of the report below.

As the two aforementioned MNOs serve their networks to other parties (such as VMNOs, due to roaming agreements or as part of emergency coverage) they have been filtered by the network provider reported in the SIM card.

More details about the methodology can be found here.

Connectivity

Connectivity: Daily disconnection time

The following graphic shows the disconnection time as the average number of minutes that each customer of each MNO experiences disconnections throughout the day. Disconnection time includes moments when a customer has no coverage at all (such as underground parkings, inside elevators, so far away from an antenna that connection is not possible...) or moments when a customer only has emergency coverage, that is, the ability to perform only emergency calls. This disconnected time may (and, in most cases, will) be discontinuous, and is the average of the daily disconnection time for all users.

Among the Emirati operators, Etisalat has the lowest disconnection time with only 6 daily minutes of disconnection, closely followed by Du with 7 daily minutes of disconnection.

Connectivity: 4G and 5G time

With the advent of the newer 5G technology older technologies such as 2G and 3G are being turned off to liberate the RF spectrum. Thus, guaranteeing at least a proper 4G coverage is one of the main goals for MNOs, and for those who already have 4G sorted out, the focus turns to 5G.

In terms of 4G and 5G connectivity, both operators have coverage of these technologies around 96% of the time.

5G penetration and usage

The possibility of a customer to use the 5G network depends on several factors:

- Their device must be 5G compatible.

- The MNO must have a 5G network.

- The client must contract a mobile plan that allows the 5G to be used, since not all MNOs offer full access to the 5G network as part of their regular plans.

In 2019, the UAE secured the top position among Arab countries and ranked fourth globally for the successful launch and deployment of 5G networks. Etisalat played a pivotal role in this achievement by introducing the first full commercial 5G mobile service in the Middle East and Africa (MEA) region in May 2019. Its domestic competitor, Du, swiftly followed suit in the subsequent month, contributing to the rapid adoption of 5G technology in the UAE.

The UAE government officially granted Etisalat and Du the 5G-capable 3.3GHz–3.8GHz spectrum in November 2018, solidifying their roles as key players in the nation's 5G landscape. By February 2023, the 5G network had expanded its coverage to encompass all major urban areas and numerous connecting highways, including prominent locations such as Abu Dhabi, Dubai, Sharjah, Fujairah, Ras Al-Kaimah, and Umm Al-Quwain.

The implementation of 5G Standalone (SA) services marked another milestone, becoming operational at the end of February 2023, further enhancing the connectivity landscape in the country.

The following charts show the percentage of users per MNO that have 5G access, and the percentage of time they are under 5G coverage. To establish whether a user is a 5G client or not, their 5G connectivity has been checked: if they have connected to the 5G network at least once, they are considered 5G clients.

In United Arab Emirates all carriers offer 5G. The operator with the most 5G clients is Du, with 18% of this type, followed closely by Etisalat with 17% of users with access to 5G.

Regarding 5G coverage time for 5G clients, Du maintains the lead, providing 5G coverage 26% of the time. Etisalat offers 5G coverage 22% of the time.

4G and 5G network status

There are two main network performance indicators used to address the network status: signal strength and signal quality. Each technology has its own measurements, but two great categories can be established:

- Very Good: the network performance for all usages should be excellent.

- Good: the network performance for all usages may present occasional difficulties but is good overall.

- Fair: most network network-dependent usages (such as calls or data usage) will have at least a decent performance.

- Degraded: network usage may be unstable and unreliable but allows for basic usage such as calls with acceptable quality and very slow data transfer rate.

- Very Degraded: apart from emergency calls network usage is nearly impossible.

There are two ways to analyze these categories: by percentage of covered area or by percentage of measurements. Most measurements take place in urban areas, where coverage is better, while in european countries most of the territory is not urban, so the percentage of area with a problematic network situation may be different from the percentage of measurements with a problematic network situation.

To ensure a fair comparison between carriers only areas with presence of both operators will be included.

In general, both operators provide good coverage in the common coverage area in the United Arab Emirates, with Du and Etisalat reaching 87% of the area with fair or better coverage.

Regarding areas with good or very good network coverage, Du leads with 54% of the area classified as such, followed by Etisalat with 51%.

Measurement-wise the general network situation is similar. Etisalat has the best result, with 83% of measurements being fair or better, while Du has 82% of measurements being at least fair.

If we focus on "Good" and "Very Good" measurements, the order remains the same: Etisalat maintains the lead with 57% of "Good" and "Very Good" measurements, followed by Du with 56% of "Good" and "Very Good" measurements.

Latency status

Latency is the measurement of how much time it takes for the information to be transmitted between the user and the network. A lower latency means a faster, and smoother network experience, whereas a higher latency means that the network experience will not be as good, or even unusable. This makes latency a good indicator for user experience. We have divided latency in four main groups:

- Excellent latency: very smooth user experience, even with the most data-intensive usage, such as gaming or 4K streaming.

- Good latency: good user experience, although gaming may not be as fluid and 4K may present occasional problems.

- Degraded latency: mediocre user experience. Gaming and 4K are either uncomfortable or impossible, videochat may present noticeable lag, messaging with multimedia may take a long time to load and loading a web may be slow.

- Bad latency: essentially unusable network. Only the lightest usage, such as sending messages without multimedia works decently.

Etisalat tops the list with 62% of its measurements classified as at least good. Meanwhile, Du has 55% of its measurements with this classification.

Regarding the percentage of measurements with excellent latency, Etisalat stands out compared to its competitor with 42% of measurements having excellent latency, while Du has 26% of measurements with excellent latency.

Sent successfully

Email sent with unlock instructions. Please check your inbox

Error sending form

There was an error processing this request. PLease try again later

To read the report please leave us your details:

An email will be sent to your address with a link to unlock it:

The information on this report is provided as of public interest by Weplan Analytics. The information on this report is provided by Weplan Analytics solely for the user's information and it is provided without warranty, guarantee or responsibility of any kind, either expressed or implied. Weplan Analytics and its employees will not be liable for any loss or damages of any nature, either direct or indirect, arising from use of the information provided in this report. Weplan Analytics is the owner of copyright in all material or information found on this report unless otherwise stated. All contents that are published in this report are safeguarded by copyright. This copyright includes the exclusive right to reproduce and distribute the contents, including reprints, translations, photographic reproductions, electronic forms (online or offline) or other reproductions of other similar kinds. Only non-commercial use may be beyond the limitations with prior written consent. Journalists are encouraged to quote information included in Weplan Analytics reports and insights as long as clear source attribution is provided. For more information, contact [email protected]