Introduction

The Malaysian mobile market comprises several operators, of which five have their own networks: CelcomDigi, Maxis, U Mobile, Unifi and Yes. CelcomDigi, Maxis and U Mobile have a combined market share of around 95% of the subscribers. Thus, the network situation for these three MNOs acts as a trustworthy barometer of the network situation in the country. A good knowledge of the network situation also allows the customers to perform fully informed decisions. The objective of this report is to provide a summary of the network situation in Malaysia for these three carriers.

This report provides a quick overview of the network situation based on the following KPIs:

- Disconnection time: daily average minutes that the users from a MNO have had only emergency coverage or no coverage.

- 4G and 5G time: percentage of time that the users from a MNO have had 4G and, if available, 5G coverage (including 5G NSA and 5G SA).

- 5G penetration and usage: percentage of users that have 5G connectivity, and percentage of time in 5G.

- Network status in the Common Coverage Area: an analysis of the network status, based on the signal strength and the signal quality, for the areas where all five MNOs provide coverage.

- Call technology usage: percentage of measurements of each call technology per MNO. This shows which technologies are mainly used by the customers.

- Mobile network latency: percentage of customers on different latency ranks. The ranks are selected according to several performance thresholds.

Summary

The data collected by Weplan Analytics shows that, overall, the three main mobile network operators have a good network situation in Malaysia. However, there are some notable differences between them.

In terms of connectivity, U Mobile and Maxis have 12 and 18 minutes per day, respectively, while CelcomDigi has 31 minutes of daily disconnection.However, in the Peninsular Malaysia region, these times are reduced, with Maxis having 5 minutes of daily disconnection, CelcomDigi having 9 minutes, and U Mobile having 10 minutes. It is relevant to highlight that all three operators offer 4G/5G coverage at least 95% of the time, which highly guarantees the quality of service provided by these operators.

These Malaysian operators offer good coverage. Regarding areas of "Good" or "Very Good" network, Maxis leads the list with 31%, followed by U Mobile with 27% and CelcomDigi with 21% of the area being at least "Good".

In terms of 5G penetration and usage, U Mobile stands out compared to its competitors with 11% of 5G customers, followed by Maxis and CelcomDigi with just 4% and 3% of 5G customers. Furthermore, U Mobile provides 5G coverage 57% of the time, while Maxis and U Mobile provide it around 45% and 38% of the time, respectively. It is important to mention that Malaysia has adopted an unusual model for the implementation of 5G, in which instead of assigning spectrum to operators, they charge them for access to the 5G spectrum, which is exclusively owned by the state entity Digital Nasional Berhad (DNB).

VoLTE technology for calls is the most commonly used by all three operators, with an average usage rate of 84%. 2G technology remains relevant in the country, being the second most-used option by these operators' customers. With the shutdown of 3G technology, 2G technology becomes the only relevant alternative, in the absence of Wi-Fi, for VoLTE.

Finally, in terms of latency, the Malaysian MNOs exceed 86% of measurements classified as good or excellent. Furthermore, Maxis stands out with 73% of measurements with excellent latency, followed by U Mobile with 66%, and finally CelcomDigi with 59% of measurements with excellent latency. When specifically examining latency in the Peninsular Malaysia region, Maxis leads the way with 85% of events exhibiting excellent latency, while CelcomDigi and U Mobile follow with 78% and 72% of events featuring excellent latency, respectively.

The main key figures are as follows:

- The main operators in Malaysia, CelcomDigi, U Mobile and Maxis, offer 4G and 5G technology coverage 95% of the time.

- On average, approximately 6% of the customers from the analyzed operators are 5G customers (i.e. customers who have a device compatible with 5G technology) and can access it around 47% of their coverage time.

- At least 87% of all MNOs' measurements have a latency good enough to offer an adequate experience for every possible use.

- VoLTE technology for calls is the most used, with an average usage rate of 84%.

Methodology

In the following pages an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

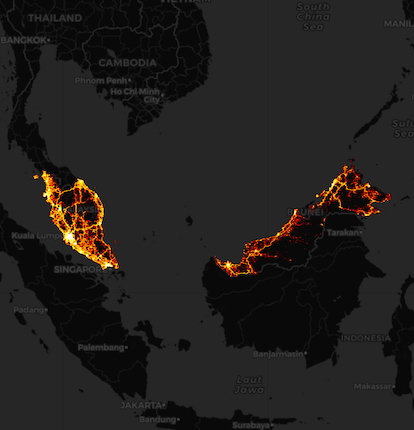

At a more general level, Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 283 million measurements collected between august and october 2023 were used.

The following map shows the density of measurements taken throughout Malaysia by Weplan Analytics.

The most relevant insights can be found in the Summary section above. A detailed account of each one comprises the rest of the report below.

As the three aforementioned MNOs serve their networks to other parties (such as VMNOs, due to roaming agreements or as part of emergency coverage) they have been filtered by the network provider reported in the SIM card.

More details about the methodology can be found here.

Connectivity

Connectivity: Daily disconnection time

The following graphic shows the disconnection time as the average number of minutes that each customer of each MNO experiences disconnections throughout the day. Disconnection time includes moments when a customer has no coverage at all (such as underground parkings, inside elevators, so far away from an antenna that connection is not possible...) or moments when a customer only has emergency coverage, that is, the ability to perform only emergency calls. This disconnected time may (and, in most cases, will) be discontinuous, and is the average of the daily disconnection time for all users.

Among the Malaysian operators, U Mobile and Maxis have the lowest disconnection time with only 12 and 18 daily minutes of disconnection respectively, followed by CelcomDigi with 31 daily minutes of disconnection. Nevertheless, it is important to note that if we focus exclusively on the Peninsular Malaysia region, these values experience a significant decrease. In this context, Maxis has 5 minutes of daily disconnection, CelcomDigi 9 minutes, and U Mobile 10 minutes.

Connectivity: 4G and 5G time

With the advent of the newer 5G technology older technologies such as 2G and 3G are being turned off to liberate the RF spectrum. Thus, guaranteeing at least a proper 4G coverage is one of the main goals for MNOs, and for those who already have 4G sorted out, the focus turns to 5G.

In terms of 4G and 5G connectivity, CelcomDigi has coverage of these technologies 95% of the time, while U Mobile and Maxis are statistically tied, achieving coverage at these technologies 97% of the time.

5G penetration and usage

The possibility of a customer to use the 5G network depends on several factors:

- Their device must be 5G compatible.

- The MNO must have a 5G network.

- The client must contract a mobile plan that allows the 5G to be used, since not all MNOs offer full access to the 5G network as part of their regular plans.

Malaysia has adopted an unusual model for the implementation of 5G. Instead of allocating spectrum to wireless carriers, it charges them for access to the 5G spectrum that is exclusively owned by the state-run entity Digital Nasional Berhad (DNB). DNB has entered investment agreements with all Malaysian MNOs to carry out the deployment of the 5G network.

The government of Malaysia recently announced it will enable the deployment of a second 5G network in 2024, citing concerns about pricing and competition with the current single state-operated network. The government will establish a new entity to manage Malaysia's second 5G network.

The following charts show the percentage of users per MNO that have 5G access, and the percentage of time they are under 5G coverage. To establish whether a user is a 5G client or not, their 5G connectivity has been checked: if they have connected to the 5G network at least once, they are considered 5G clients.

In Malaysia all carriers offer 5G. The operator with the most 5G clients is U Mobile, with 11% of this type, followed by Maxis and CelcomDigi with only 4% and 3%, respectively.

Regarding 5G coverage time for 5G clients, there are some differences between operators: U Mobile leads, providing 5G coverage 57% of the time; Maxis and CelcomDigi provide 5G coverage 45% and 38% of the time, respectively.

Given that 5G is not deployed by MNOs, differences in availability may come for the particular investment made by each MNO to the DNB or by customers preferences, rather than differences in the network deployment.

4G and 5G network status

There are two main network performance indicators used to address the network status: signal strength and signal quality. Each technology has its own measurements, but five great categories can be established:

- Very Good: the network performance for all usages should be excellent.

- Good: the network performance for all usages may present occasional difficulties but is good overall.

- Fair: most network network-dependent usages (such as calls or data usage) will have at least a decent performance.

- Degraded: network usage may be unstable and unreliable but allows for basic usage such as calls with acceptable quality and very slow data transfer rate.

- Very Degraded: apart from emergency calls network usage is nearly impossible.

There are two ways to analyze these categories: by percentage of covered area or by percentage of measurements. Most measurements take place in urban areas, where coverage is better, while in european countries most of the territory is not urban, so the percentage of area with a problematic network situation may be different from the percentage of measurements with a problematic network situation.

To ensure a fair comparison between carriers only areas with presence from all MNOs have been analyzed, taking into account exclusively the 4G technology.

The overall network situation in the common coverage area for the analyzed operators, area-wise, is good. Maxis presents the best result with 78% of the area with fair or better coverage, followed closely by CelcomDigi with 73% and, in last place U Mobile, with 66% of the area rated as at least fair.

Regarding areas with good or very good network coverage, Maxis tops the list with 31% of the area classified as such, followed by U Mobile with 27% and CelcomDigi with 21%.

Measurement-wise the general network situation is similar. Maxis has the best result, with 77% of measurements being fair or better. Followed by CelcomDigi and U Mobile with 70% and 67% of measurements being at least fair, respectively.

If we focus on "Good" and "Very Good" measurements, the order remains the same: Maxis maintains the lead with 45% of "Good" and "Very Good" measurements, followed by CelcomDigi with 37% and U Mobile with 34% of "Good" and "Very Good" measurements.

Call type percentage

Although 2G and 3G are capable of data usage, the advent of 4G and more recently 5G technologies have relegated them to mostly call usage. The absence of 4G-based call technology ensured that 2G and 3G were still relevant, since they were the unique technologies to make a phone call. The development of VoLTE (Voice over LTE) calls during the 2010s marked the beginning of the end for these legacy technologies.

However, not all customers can benefit from VoLTE calls. For a customer to use this technology several conditions must be met:

- Their MNO must provide 4G and VoLTE.

- They must have a phone capable of performing VoLTE calls.

- They must have a mobile plan that includes VoLTE calls.

- Their phone must be homologated by the MNO and the manufacturer to perform VoLTE calls.

The fourth condition means that a customer can have VoLTE with one MNO but lack of it with a different MNO, using the same cellphone. If a customer connected to 4G without VoLTE capabilities tries to perform a call, a hand-off process to 2G or 3G network takes place. Depending on the method this process is called CSFB (the most common one) or SRVCC. Aside from those technologies, VoWiFi (Voice over Wi-Fi) is also used when a Wi-Fi network is available.

VoLTE technology is the most commonly used, with U Mobile's customers using this technology 88% of the time, followed by Maxis's customers at 84% of the time, and CelcomDigi's customers at only 81% of the time. The second most used technology is 2G (either directly or through CSFB), with CelcomDigi users utilizing it 12% of the time, followed by Maxis users at 10%, and U Mobile users at 9%.

Malaysia originally planned to shut down all 3G networks by the end of 2021. However, it was discovered that some 3G sites were still operational at that time. The Malaysian Communications and Multimedia Commission (MCMC) explained that the delay in closing the remaining 3G sites was due to floods and the monsoon season, leading to a full closure being postponed until early 2022.

The release of the spectrum previously used by 3G networks contributes to strengthening the coverage and capacity of 4G networks. Following the deactivation of the 3G networks, customers who have devices compatible only with 3G and do not support 4G/LTE or 5G will be limited to accessing the 2G network. The latter will mainly be used for basic voice calls and text messages.

Latency status

Latency is the measurement of how much time it takes for the information to be transmitted between the user and the network. A lower latency means a faster, and smoother network experience, whereas a higher latency means that the network experience will not be as good, or even unusable. This makes latency a good indicator for user experience. We have divided latency in four main groups:

- Excellent latency: very smooth user experience, even with the most data-intensive usage, such as gaming or 4K streaming.

- Good latency: good user experience, although gaming may not be as fluid and 4K may present occasional problems.

- Degraded latency: mediocre user experience. Gaming and 4K are either uncomfortable or impossible, videochat may present noticeable lag, messaging with multimedia may take a long time to load and loading a web may be slow.

- Bad latency: essentially unusable network. Only the lightest usage, such as sending messages without multimedia works decently.

The three MNOs present a similar latency situation. Maxis leads with 92% of its events classified as at least good, closely followed by U Mobile with 90%, and CelcomDigi with 87% of their events with this classification.

Regarding the percentage of measurements with excellent latency, Maxis once again tops the list, with 73% of measurements having excellent latency. It is followed by U Mobile with 66% of measurements classified as such. In last place is CelcomDigi, with 59% of measurements with excellent latency. If we focus exclusively on the Peninsular Malaysia region, Maxis has 85% of events with excellent latency, followed by CelcomDigi and U Mobile with 78% and 72% of events with excellent latency, respectively.

Sent successfully

Email sent with unlock instructions. Please check your inbox

Error sending form

There was an error processing this request. PLease try again later

To read the report please leave us your details:

An email will be sent to your address with a link to unlock it:

The information on this report is provided as of public interest by Weplan Analytics. The information on this report is provided by Weplan Analytics solely for the user's information and it is provided without warranty, guarantee or responsibility of any kind, either expressed or implied. Weplan Analytics and its employees will not be liable for any loss or damages of any nature, either direct or indirect, arising from use of the information provided in this report. Weplan Analytics is the owner of copyright in all material or information found on this report unless otherwise stated. All contents that are published in this report are safeguarded by copyright. This copyright includes the exclusive right to reproduce and distribute the contents, including reprints, translations, photographic reproductions, electronic forms (online or offline) or other reproductions of other similar kinds. Only non-commercial use may be beyond the limitations with prior written consent. Journalists are encouraged to quote information included in Weplan Analytics reports and insights as long as clear source attribution is provided. For more information, contact [email protected]