Introduction

The Japanese mobile market comprises several operators, of which four have their own networks with nation-wide coverage: NTT Docomo, KDDI au, Softbank and Rakuten Mobile. Thus, the network situation for these MNOs acts as a trustworthy barometer of the network situation in the country. A good knowledge of the network situation also allows the customers to perform fully informed decisions.

The objective of this report is to provide a summary of the network situation in Japan for these four carriers.

This report provides a quick overview of the network situation based on the following KPIs:

- Disconnection time: daily average minutes that the users from a MNO have had only emergency coverage or no coverage.

- 4G and 5G time: percentage of time that the users from a MNO have had 4G and, if available, 5G coverage (including 5G NSA and 5G SA).

- 5G penetration and usage: percentage of users that have 5G connectivity, percentage of time in 5G and percentage of active usage of 5G.

- Network status in the Common Coverage Area: an analysis of the network status, based on the signal strength and the signal quality, for the areas where all two MNOs provide coverage.

- Call type: percentage of use of each call type by operator. This shows which technologies each of their customers primarily use.

- Mobile network latency: percentage of customers on different latency ranks. The ranks are selected according to several performance thresholds.

Summary

The Japanese telecommunications market is controlled by four operators with their own networks and MVNOs that together hold 99,9% of the market: NTT Docomo, KDDI au, Softbank and Rakuten Mobile. In this competition to increase its customer base, NTT Docomo is the number 1 operator in Japan with 34,9% of the market (40,7% if we count his MVNOs). Following closely are KDDI au, with 26.8% of the market (30,5% with MVNOs) and Softbank with 20,4% (25,9% with MVNOs). Rakuten closes the list with 2.6% (2,8% with MVNOs).

Each operator's network performance is very similar. However, there are some notable differences between them.

If we take into account the disconnection time, Softbank is the operator that remains without coverage for the least amount of time compared to its competitors.

Regarding 5G, KDDI au is the operator with the highest percentage of 5G customers (47%).

On the other hand, NTT Docomo is the operator that presents the longest 5G coverage time for its 5G clients (72%), while Softbank is the operator that has the longest time of use of 5G coverage with 9%.

Docomo and Softbank are the operators that offers the best quality of 4G and 5G coverage, both in area and in measurements.

If we look at the types of calls, KDDI au and Rakuten Mobile customers use VoLTE in all his calls, while Docomo and Softbank still retain a small percentage of customers who make their calls using 3G technology.

Finally, regarding latency, in general terms, Softbank has better latency than its competitors, with 87% of its measurements being rated as at least good latency.

The main key figures are the following:

- The four main operators (NTT Docomo, KDDI au, Softbank and Rakuten Mobile) in Japan provide 4G or 5G coverage to their customers at least 98% of the time.

- 5G still has room for growth in the country and the number of 5G users is gradually increasing. The MNO with the most 5G clients is KDDI au (47%), followed by Softbank (41%), Rakuten Mobile (32%) and NTT Docomo (29%).

- Regarding 5G coverage time for 5G clients, NTT Docomo provides 5G coverage 72% of the time but only active use 6% of the time. It is followed by KDDI au with 56% of the time with 5G coverage and 7% active use, Rakuten Mobile with 49% of the time with 5G coverage and 3% active use, and finally Softbank with 37% of the time with coverage 5G and active use of 9%.

- VoLTE calls are especially relevant for the four operators, accounting for at least 97% of total calls.

- At least 80% of measurements from all operators have good enough latency for a decent experience in all possible types of use.

Methodology

In the following pages an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

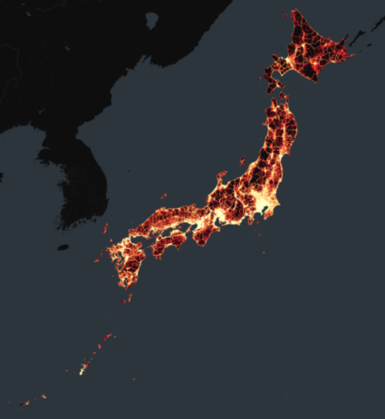

At a more general level, Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 7,000 million measurements collected between March and May 2024 were used. The following map shows the density of measurements taken throughout Japan by Weplan Analytics.

As the four aforementioned MNOs serve their networks to other parties (such as VMNOs, due to roaming agreements or as part of emergency coverage) they have been filtered by the network provider reported in the SIM card.

More details about the methodology can be found here.

Connectivity

Connectivity: Daily disconnection time

The following graphic shows the disconnection time as the average number of minutes that each customer of each MNO experiences disconnections throughout the day.

Disconnection time includes moments when a customer has no coverage at all (such as underground parkings, inside elevators, so far away from an antenna that connection is not possible...) or moments when a customer only has emergency coverage, that is, the ability to perform only emergency calls. This disconnected time may (and, in most cases, will) be discontinuous, and is the average of the daily disconnection time for all users.

Among Japanese operators, Softbank has the shortest daily disconnection time, with only 16 minutes of daily disconnections.

Connectivity: 4G and 5G time

As a result of the development of 5G technology, legacy technologies such as the 2G and 3G networks are being turned off with the aim of freeing up electromagnetic spectrum to make room for more modern technologies such as 4G and 5G. This is because the frequencies are limited, so it is necessary to turn off the old ones so that the new ones can occupy those frequencies. Thus, one of the main objectives of operators is to guarantee at least adequate 4G coverage, and for those that already meet this objective, the focus turns to 5G.

Regarding 4G and 5G connectivity, it can be considered excellent work by the four operators, who maintain 98% of the time with 4G or higher coverage.

5G penetration and usage

Although the first 5G tests began in Japan in 2010, 5G commercialization did not take place until 2020. NTT Docomo, KDDI au and Softbank began commercializing 5G NSA at the end of March 2020, while Rakuten did so a little later, in September 2020.

This start of 5G commercialization was not uniform, but was divided into prefectures. Docomo began the deployment in 29 of the 47 prefectures, while KDDI deploy in 15, Softbank 7 and Rakuten 6.

In order to accelerate this 5G deployment, Softbank and KDDI joined forces to create the 5G JAPAN company, with the aim of sharing infrastructure and accelerating 5G deployment to rural areas.

In 2021, the first deployments of 5G SA were carried out, with Softbank being the first to officially market it in October 2021. In December 2021, commercialization was carried out by Docomo, and a few years later it was KDDI that offered this technology, on the 13th. April 2023. Rakuten has implemented 5G SA network capabilities in its commercial network, but does not yet have a full 5G SA network.

The Japanese government has set a goal for 99% of the population to have 5G networks by the end of 2030, with the Ministry of the Interior and Communications (MIC) ensuring this goal. Along with the deployment of 5G came the first shutdowns of 3G technology. KDDI made the 3G shutdown official in March 2022, while Softbank suspended 3G on April 15, 2024, except in areas where this service was needed for emergencies. In these areas it will be turned off on July 31. Docomo plans to definitively shut down 3G in March 2026, although it has already closed the 2100 MHz segment for this technology. In the case of Rakuten, it did not originally offer 3G services.

The possibility of a customer to use the 5G network depends on several factors:

- Their device must be 5G compatible.

- The MNO must have a 5G network.

- The client must contract a mobile plan that allows the 5G to be used, since not all MNOs offer full access to the 5G network as part of their regular plans.

The following charts show the percentage of users per MNO that have 5G access, and the percentage of time they are under 5G coverage. To establish whether a user is a 5G client or not, their 5G connectivity has been checked: if they have connected to the 5G network at least once, they are considered 5G clients.

Percentage of 5G users by operator

The percentage of 5G clients in Japan is still growing in the four operators analyzed in this section, with KDDI being the one with the most 5G clients (47%), followed by Softbank (41%), Rakuten (32%) and Docomo (29%).

Percentage of time spent under 5G coverage for 5G clients by carrier in Japan

If we look at the time in which each user has 5G coverage available, Docomo is the clear winner with 72% of the time with 5G coverage available. It is followed by KDDI with 56%, Rakuten with 49% and Softbank with 37%.

Percentage of 5G usage time for 5G users

When a user connects to the 5G network, they can do so under a Stand Alone (5G SA, pure 5G) or Non Stand Alone (5G NSA, 5G supported by the LTE network) connection.

When a user connects to the 5G NSA network, they can use only the LTE part (although they still see on their terminal that it is connected to 5G) or also the 5G part. Connecting in one way or another is mainly due to the use and capacity of the network, with the 5G network being prioritized for intensive data uses (e.g. streaming, video calls, video games, etc.) and leaving the 4G network for less intensive uses (e.g. messaging, low consumption web browsing, etc.).

The following graph shows the percentage of time that users are connected to a 5G network and are also using 5G technology.

If we emphasize the time that each user uses the available 5G, Softbank users use the 5G network 9% of the time, followed by KDDI with 7%, Docomo with 6% and Rakuten with 3%.

4G and 5G network status

There are two main network performance indicators used to address the network status: signal strength and signal quality. Each technology has its own measurements, but two great categories can be established:

- Very Good: the network performance for all usages should be excellent.

- Good: the network performance for all usages may present occasional difficulties but is good overall.

- Fair: most network network-dependent usages (such as calls or data usage) will have at least a decent performance.

- Degraded: network usage may be unstable and unreliable but allows for basic usage such as calls with acceptable quality and very slow data transfer rate.

- Very Degraded: apart from emergency calls network usage is nearly impossible.

There are two ways to analyze these categories: by percentage of covered area or by percentage of measurements.

Most measurements take place in urban areas, where coverage is better.

However, it is important to note that in most countries the majority of the territory is not urban, so the percentage of area with a problematic network situation may be different from the percentage of measurements with a problematic network situation.

In general, all operators offer decent coverage in the common coverage area in Japan.

Docomo and Softbank presents the best result tied with 86% of the area rated as at least fair. Following are Rakuten with 79% and KDDI with 78%. Furthermore, it is worth noting that Docomo is the operator with the largest area rated as at least good, with 52%.

If you look at measurements instead of area, the general situation is very similar. Softbank is the operator with the best results, since 83% of the measurements are classified as, at least, fair. It is followed by Docomo with 80%, KDDI with 75% and Rakuten with 74%.

Call type percentage

Although 2G and 3G technologies allow the use of data, the development of 4G and 5G has left these technologies largely relegated to use in phone calls.

However, not all customers can benefit from VoLTE calls, since in order for them to be used, the following conditions must be met:

- Your MNO must provide 4G and VoLTE.

- They must have a phone capable of making VoLTE calls and a mobile plan that includes VoLTE.

- Your phone must be approved by the MNO and the manufacturer to make VoLTE calls.

The last condition means that a customer, without changing their phone, can have VoLTE with one operator, but not have it with another. When a 4G connected customer without VoLTE capability (for any reason) attempts to make a call, a handover process to the 2G or 3G network occurs.

This process, depending on the method applied, is called CSFB (the most common) or SRVCC. In addition, there is also VoWiFi (Voice over Wi-Fi) technology, which is used when a Wi-Fi network is available.

In Japan, VoLTE technology is the most used by customers of the 4 operators, with at least 97% of calls using this technology.

In Docomo and Softbank we can see small percentages of 3G calls, because these operators have not yet shut down this network.

Latency status

Latency is the measurement of how much time it takes for the information to be transmitted between the user and the network. A lower latency means a faster, and smoother network experience, whereas a higher latency means that the network experience will not be as good, or even unusable. This makes latency a good indicator for user experience. We have divided latency in four main groups:

- Excellent latency: very smooth user experience, even with the most data-intensive usage, such as gaming or 4K streaming.

- Good latency: good user experience, although gaming may not be as fluid and 4K may present occasional problems.

- Degraded latency: mediocre user experience. Gaming and 4K are either uncomfortable or impossible, videochat may present noticeable lag, messaging with multimedia may take a long time to load and loading a web may be slow.

- Bad latency: essentially unusable network. Only the lightest usage, such as sending messages without multimedia works decently.

The four MNOs present a similar latency situation, with at least 80% of their measurements rated as good or excellent. Softbank leads this category, with 87% of its measurements rated good or excellent. It is followed by Rakuten with 86%, KDDI with 82% and Docomo, with 80% of measurements rated as good or excellent. Finally, all operators have a similar percentage of measurements with poor latency or degraded latency.

Sent successfully

Email sent with unlock instructions. Please check your inbox

Error sending form

There was an error processing this request. PLease try again later

To read the report please leave us your details:

An email will be sent to your address with a link to unlock it:

The information on this report is provided as of public interest by Weplan Analytics. The information on this report is provided by Weplan Analytics solely for the user's information and it is provided without warranty, guarantee or responsibility of any kind, either expressed or implied. Weplan Analytics and its employees will not be liable for any loss or damages of any nature, either direct or indirect, arising from use of the information provided in this report. Weplan Analytics is the owner of copyright in all material or information found on this report unless otherwise stated. All contents that are published in this report are safeguarded by copyright. This copyright includes the exclusive right to reproduce and distribute the contents, including reprints, translations, photographic reproductions, electronic forms (online or offline) or other reproductions of other similar kinds. Only non-commercial use may be beyond the limitations with prior written consent. Journalists are encouraged to quote information included in Weplan Analytics reports and insights as long as clear source attribution is provided. For more information, contact [email protected]