Introduction

The Egyptian mobile market comprises several operators, of which four have their own networks with nation-wide coverage: Etisalat, Orange, Telecom Egypt and Vodafone. Thus, the network situation for these MNOs acts as a trustworthy barometer of the network situation in the country. A good knowledge of the network situation also allows the customers to perform fully informed decisions.

The objective of this report is to provide a summary of the network situation in Egypt for these four MNOs.

This report provides a quick overview of the network situation based on the following KPIs:

- Disconnection time: daily average minutes that the users from a MNO have had only emergency coverage or no coverage.

- 4G and 5G time: percentage of time that the users from a MNO have had 4G and, if available, 5G coverage (including 5G NSA and 5G SA).

- 5G penetration and usage: percentage of users that have 5G connectivity, percentage of time in 5G and percentage of active usage of 5G.

- Network status in the Common Coverage Area: an analysis of the network status, based on the signal strength and the signal quality, for the areas where all MNOs provide coverage.

- Call type: percentage of use of each call type by operator. This shows which technologies each of their customers primarily use.

- Mobile network latency: percentage of customers on different latency ranks. The ranks are selected according to several performance thresholds.

Summary

The Egyptian telecommunications market is controlled by four operators with their own networks that together hold almost 100% of the market:: Etisalat, Orange, Telecom Egypt and Vodafone.

In this competition to increase its customer base, Vodafone is the number 1 operator in Egypt with 38.2% of the market. Following are Etisalat with 28% of the market, Orange with 23.5% and Telecom Egypt with 10.2%.

The network performance of each operator has its differences compared to the others. We will analyze the performance of each of them:

If we take into account the disconnection time, Vodafone is the operator that remains without coverage for the least amount of time compared to its competitors.

Telecom Egypt is the operator that offers 4G coverage to its users the longest, with 88% of the time, and it is also the one that offers the best quality of 4G coverage, both in area and in measurements.

If we look at the types of calls, Vodafone is the operator in which users use VoLTE the most in their calls (53%).

Finally, regarding latency, in general terms, Telecom Egypt has better latency than its competitors, with 49% of its measurements being rated as at least good latency.

The main key figures are the following:

- The four main operators (Etisalat, Orange, Vodafone, Telecom Egypt) in Egypt provide 4G coverage to their customers at least 77% of the time.

- 5G technology is not yet available in Egypt.

- Telecom Egypt is the operator that offers the best quality of 4G coverage, both in area and measurements.

- Half of the calls made in Egypt are made using VoLTE technology.

- Telecom Egypt is the operator that has the best latency for a decent experience in all possible types of use, with 49% of measurements rated at least good.

Methodology

In the following pages an in-depth description of each analyzed KPI can be found, including the methodology and rationale behind them. At a more general level, the following paragraph describes the data collection methodology.

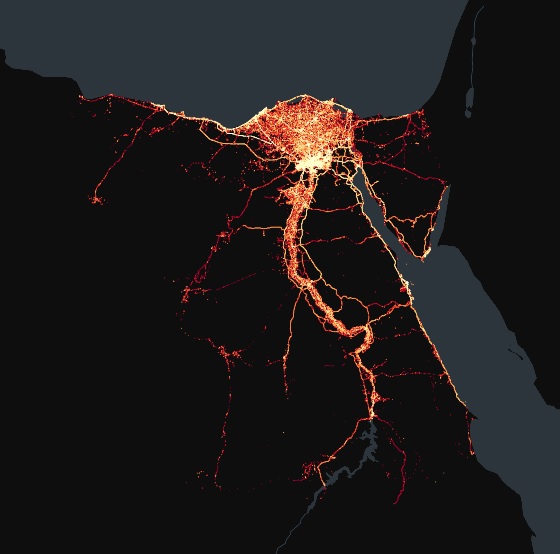

At a more general level, Weplan Analytics collects crowdsourced data from more than 200 million devices in 31 countries. For this analysis, 600 million measurements collected between April and June 2024 were used. The following map shows the density of measurements taken throughout Egypt by Weplan Analytics.

More details about the methodology can be found here.

Connectivity

Connectivity: Daily disconnection time

The following graphic shows the disconnection time as the average number of minutes that each customer of each MNO experiences disconnections throughout the day.

Disconnection time includes moments when a customer has no coverage at all (such as underground parkings, inside elevators, so far away from an antenna that connection is not possible...) or moments when a customer only has emergency coverage, that is, the ability to perform only emergency calls. This disconnected time may (and, in most cases, will) be discontinuous, and is the average of the daily disconnection time for all users.

Among Egyptian operators, Vodafone has the shortest daily disconnection time, with only 24 minutes of daily disconnections.

Connectivity: 4G time

Telecom Egypt has the best 4G coverage time for its customers, maintaining this coverage 88% of the time.

5G penetration and usage

Currently, operators in Egypt do not yet have 5G technology.

Telecom Egypt is the only operator licensed to install and operate 5G in the country, although all operators already have suitable frequencies for 5G services, achieved in a previous auction in 2022 for the 2.6 GHz band.

With the recent announcement of Telecom Egypt's partnership with Nokia, along with Ericsson's partnership with Vodafone and Orange, it is expected that by the end of the year one of them will be the first operator to bring 5G to the country.

4G network status

There are two main network performance indicators used to address the network status: signal strength and signal quality. Each technology has its own measurements, but five great categories can be established:

- Very Good: the network performance for all usages should be excellent.

- Good: the network performance for all usages may present occasional difficulties but is good overall.

- Fair: most network network-dependent usages (such as calls or data usage) will have at least a decent performance.

- Degraded: network usage may be unstable and unreliable but allows for basic usage such as calls with acceptable quality and very slow data transfer rate.

- Very Degraded: apart from emergency calls network usage is nearly impossible.

There are two ways to analyze these categories: by percentage of covered area or by percentage of measurements.

Most measurements take place in urban areas, where coverage is better.

However, it is important to note that in most countries the majority of the territory is not urban, so the percentage of area with a problematic network situation may be different from the percentage of measurements with a problematic network situation.

In general, all operators offer decent coverage in the common coverage area in Egypt.

Telecom Egypt is the operator with the best results with 82% of the area rated as at least fair. Following are Orange with 80%, Vodafone with 74% and Etisalat with 66%.

If you look at measurements instead of area, the general situation is very similar.

Telecom Egypt is the operator with the best results with 76% of the measurements are classified as, at least, fair. It is followed by Orange with 72%, Etisalat with 71% and Vodafone with 69%.

Call type percentage

Although 2G and 3G technologies allow the use of data, the development of 4G and 5G has left these technologies largely relegated to use in phone calls.

However, not all customers can benefit from VoLTE calls, since in order for them to be used, the following conditions must be met:

- Your MNO must provide 4G and VoLTE.

- They must have a phone capable of making VoLTE calls and a mobile plan that includes VoLTE.

- Your phone must be approved by the MNO and the manufacturer to make VoLTE calls.

The last condition means that a customer, without changing their phone, can have VoLTE with one operator, but not have it with another. When a 4G connected customer without VoLTE capability (for any reason) attempts to make a call, a handover process to the 2G or 3G network occurs.

This process, depending on the method applied, is called CSFB (the most common) or SRVCC. In addition, there is also VoWiFi (Voice over Wi-Fi) technology, which is used when a Wi-Fi network is available.

VoLTE technology is the most used by Vodafone customers, with at least 53% of calls using this technology. It is followed by Telecom Egypt with 51%, Etisalat with 45% and Orange with 39%.

Latency status

Latency is the measurement of how much time it takes for the information to be transmitted between the user and the network. A lower latency means a faster, and smoother network experience, whereas a higher latency means that the network experience will not be as good, or even unusable. This makes latency a good indicator for user experience. We have divided latency in four main groups:

- Excellent latency: very smooth user experience, even with the most data-intensive usage, such as gaming or 4K streaming.

- Good latency: good user experience, although gaming may not be as fluid and 4K may present occasional problems.

- Degraded latency: mediocre user experience. Gaming and 4K are either uncomfortable or impossible, videochat may present noticeable lag, messaging with multimedia may take a long time to load and loading a web may be slow.

- Bad latency: essentially unusable network. Only the lightest usage, such as sending messages without multimedia works decently.

There are clear differences in latency between operators.

Telecom Egypt presents the best results with 49% of their measurements rated at least good. Etisalat follows closely with 48%, Orange with 35% and Vodafone with 32% of measurements rated at least good.

Sent successfully

Email sent with unlock instructions. Please check your inbox

Error sending form

There was an error processing this request. PLease try again later

To read the report please leave us your details:

An email will be sent to your address with a link to unlock it:

The information on this report is provided as of public interest by Weplan Analytics. The information on this report is provided by Weplan Analytics solely for the user's information and it is provided without warranty, guarantee or responsibility of any kind, either expressed or implied. Weplan Analytics and its employees will not be liable for any loss or damages of any nature, either direct or indirect, arising from use of the information provided in this report. Weplan Analytics is the owner of copyright in all material or information found on this report unless otherwise stated. All contents that are published in this report are safeguarded by copyright. This copyright includes the exclusive right to reproduce and distribute the contents, including reprints, translations, photographic reproductions, electronic forms (online or offline) or other reproductions of other similar kinds. Only non-commercial use may be beyond the limitations with prior written consent. Journalists are encouraged to quote information included in Weplan Analytics reports and insights as long as clear source attribution is provided. For more information, contact [email protected]